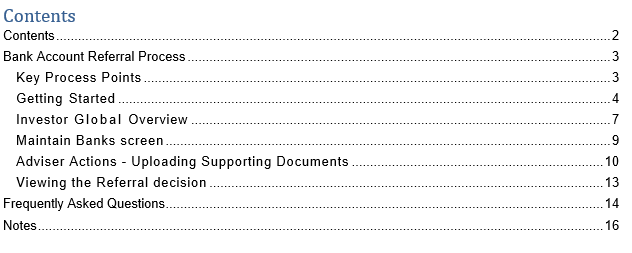

Contents

Bank Account Referral Process

This guide details the steps to be taken by the Adviser when new Bank Details added to the Portal have not been Validated through the GB Group integration.

All existing Bank Accounts on the Portal will be validated by SS&C Hubwise at a future date. Until this point, all existing Bank Accounts will display the status ‘To be validated’ on the Maintain Bank screen. No further action is required for these Accounts at this stage and there will be no impact on existing withdrawals or contributions for these Clients.

Key Process Points

- If a new Bank Account is not Validated, its Status will show on the Portal as Referred and the Adviser will receive notification via an email sent to their registered account. A Referral email will contain details of the referred account and wording similar to the below: -

“Thank you for providing the bank details for XXXXXXXX, however we were unable to validate the account and now require further documentation as evidence for validation purposes.”

- The email will also provide details of the supporting documentation required, a copy of a Bank Statement dated within the last six months, and a link to the process for uploading this to the Portal on the SS&C Hubwise Knowledge Base.

- Advisers should certify the document uploaded as a copy of the original, ensuring the certification is dated and includes the Adviser’s signature. SS&C Hubwise will then review and update the status of the account accordingly.

- If an Account status is changed from Referred to Passed following review, the Adviser will again be notified via email.

- If an Account remains in a Referred state and the required supporting documents are not provided within 14 days, a reminder email will be sent to the Adviser. Following this, if no further action is taken, the Bank Details will automatically be rejected.

- Reports detailing the outstanding Referred Bank Accounts awaiting further information can be found on the Portal in the Company Reports section. The ‘HUB_Bank_Referrals’ csv report can be found using the drop-down Company Reports> Regulatory Reporting> Financial Crime Reporting. This will only appear if you have any referred Bank Accounts.

Documentation required

To help us validate the Client’s Bank Account, please provide us with one of the following: -

- A void Cheque

- An original Bank Statement detailing the Client’s address

- An online Bank Statement including, as a minimum, the full Bank Name, Account Number, Sort Code and Client’s full Name

- A Giro or Paying-In Slip

- An original letter from the Bank confirming the Client’s details

You should create a clear, colour copy of the physical ID.. You should then upload the documentation via the Bank Maintenance screen on the SS&C Hubwise Portal.

Please DO NOT upload evidence via Investor Documents.

Note - We do not require certified copies of Bank Statements for UK low risk Clients. For high risk Clients we would ask for a certified copy as part of the Enhanced Due Diligence process.

SS&C Hubwise also reserve the right to ask for a certified copy of any Bank Statement if we feel it is necessary to detect and prevent fraud.

Note: The review process for Bank Validation documentation received typically takes one working day.

Getting Started

On accessing the Portal you will be taken to the Dashboard screen below.

For Users with no linked Investor or Account details (e.g., Admin staff) the Dashboard will show as below.

Now select the Main Menu icon at the top of the screen.

From the ribbon shown select the Investors menu.

Then either Dashboard/Manage or Investor Accounts.

Dashboard/Manage allows you to search for any Investor on the Portal whether they have any in-force Accounts or not. Selecting the Investor will take you to their Global Overview.

Investor Accounts allows you to search for an individual Account. The Account must be in-force to be visible here. Select the Globe button on the right to access the Investor’s Global Overview.

Investor Global Overview

To begin the Referral process first locate the required Account on the right of the screen and click on the All Account Actions cog in the bottom right of this tile.

The All Account Actions menu will now expand as shown.

Select Bank Details to open the Maintain Banks screen.

Maintain Banks screen

Any existing ‘To be validated’ Bank Details, Bank Details that have Passed validation checks or have been Approved manually following review by SS&C Hubwise will be displayed in the Active section.

Any Banks that have been Referred by the initial validation checks, submitted for review or Referred for further information following review by SS&C Hubwise, will be displayed in the Referred section.

Any Banks that have been Rejected following review by SS&C Hubwise or where supporting documents have not been received within the required timescales will be displayed in the Rejected section of the screen.

Adviser Actions - Uploading Supporting Documents

From the Referred Tab, select the Bank to submit for review and click on Actions

The Timeline option displays the historical activity for the chosen Bank along with the associated dates.

The Upload Documents option allows the relevant supporting documents to be uploaded in either PNG, JPG or PDF format.

Please upload the required Documents as detailed in this guide.

Note: The review process for Bank Validation documentation typically takes one working day.

Once selected, click on Accept to upload.

The status of the Bank on the Portal will now change from Referred to Submitted.

Viewing the Referral decision

Once the Referral has been reviewed, the Adviser will be able to view the SS&C Hubwise decision and comments by returning to the Maintain Banks screen.

In addition, if an Account status is changed from Referred to Passed following review, the Adviser will be notified directly via email.

Banks that are Approved by SS&C Hubwise will now be displayed in the Active tab.

The status of the Bank will show as Valid.

Any Banks requiring further information will remain in the Referred tab.

The Adviser can view the Timeline that details any comments from SS&C Hubwise and action accordingly.

If additional documentation is to be obtained and uploaded, then the steps detailed in the previous section should be repeated.

SS&C Hubwise will then make a further decision on the Bank status and update accordingly.

Any Banks that are rejected by SS&C Hubwise will be displayed in the Rejected tab.

The status of the Bank will show as Rejected.

Bank Verification and Third Party Products

SS&C Hubwise offers a wide range of Third Party products on the Platform. These operate differently in that all money in and out is processed via a Third Party Bank Account and not an Investor Bank Account.

Our approach to these Third Party products is as follows: -

- No automated referral notifications are issued to Advisers for Third Party products.

- Investors will be notified once the Account is set up.

- Third Party Bank accounts will be auto-matched based on naming convention, Bank Name and Sort Code. Given this approach, it is very important to check that the details of the Bank exactly match the Third Party Account set up.

- To check the referral status on a Third Party product please use the Maintain Bank screen or the Bank Referral report on the Portal.

Frequently Asked Questions

Bank Account Validation

As a Partner firm, are there any actions I need to take?

You will need to add the relevant supporting documentation for any Bank Details added to the Portal which are Referred following validation checks.

What supporting documentation is needed to approve the Referred banks?

Please see the Bank Account Referral Process guide for documentation required.

Following uploading of Documents, how long does the Validation process typically take?

The Validation process typically takes one working day.

When do Investors and Advisers receive automated notifications during this process?

Investors will receive a notification when: -

- A Bank Account is added.

- A Bank Account is removed

Advisers will receive a notification for the instances below: -

- Confirmation that a Bank Account is verified successfully.

- A referral notification – with request to upload evidence.

- A chaser notification 14 days after the referral where evidence has yet to be uploaded.

How quickly are notifications sent?

Notifications are sent instantaneously.

Will multiple notifications be received where Bank details are required more than once?

E.g., For both a new Single contribution and ongoing Regular contributions?

No. Only one Validation request will be made per Bank Account. This applies to Singles and Regulars within the same Account and also if the same Bank Account is added to an additional Account.

Is there any cost to the Investor/Partner Firm for this process?

There is no charge for this process.

Bank Account Maintenance

Is Maintain Banks available on all products?

This is available only on all Platform products.

How do I view all the Banks for an Investor?

Go to the Investor Banks tab on the Client Overview screen to see an overview of all the Banks for the chosen Investor.

I cannot see the Bank Details menu option available to my Client Account - why?

Please escalate locally in the first instance to ensure the correct permissions have been enabled for your Portal profile, referring to the Portal Permissions – Descriptions and roles document on the Hubwise Knowledgebase. For further support, contact SS&C Hubwise via Freshdesk.

How do I view all the Banks for an Investor?

Go to the Investor Banks tab on the Client Overview screen to see an overview of all the Banks for the chosen Investor.

I cannot see the Bank Details menu option available to my Client Account - why?

Please escalate locally in the first instance to ensure the correct permissions have been enabled for your Portal profile, referring to the Portal Permissions – Descriptions and roles document on the SS&C Hubwise Knowledgebase. For further support, contact SS&C Hubwise via Freshdesk.

How do I add an Employer Bank to an Account?

These can be added in the Application journey or by the Add New Bank option as detailed in the Bank Account Maintenance Process guide.

Are Withdrawals allowed only to the Primary Bank?

No, Single and Regular Withdrawals can be paid out to any Validated Bank. The required Bank can be selected from the dropdown during the Withdrawals journey on the Portal.

For Internal Use Only:

Business Owner Team: L&D Support

Business Owner Contact Details: L&DSupport@uk.sscinc.com/Keri.Binks@uk.sscinc.com

Note: All Knowledge Base updates are approved by the Business Owner.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article