SS&C Hubwise – AML Uplift FAQ’s – December 2025

Overview

On 17th December 2024 Hubwise moved to a non-reliance AML model for new investors. As we no longer follow a reliance approach for AML there is a requirement to uplift the investors on-boarded through the reliance model, to the new standards. These steps will give our partner firms and investors greater assurance to the robustness of our AML controls and help prevent financial crimes such as money laundering and fraud.

These changes will apply to the following products on the SS&C Hubwise platform:-

- SS&C Hubwise ISA

- SS&C Hubwise GIA

- SS&C Hubwise JISA

- SSS&C Hubwise SIPP

- All other 3rd party products are not included in AML verification process.

- Not if the investor has opened their first account under the new non-reliance model (post 17th Dec 2024) and provided all relevant details.

- Not if the investor only holds a 3rd party product.

- Minors will not be included in the request for additional Know your customer (KYC) information.

- Ahead of the AML Uplift process, SS&C Hubwise will be closing the following accounts so that they are excluded.

- Accounts with a zero balance.

- Accounts with a balance under £100 with no transactions in the last 6 months (note that this will not include SIPP accounts).

The process

The verification is required at individual investor level with the aim of verifying all investors through 2025. Uplift activity started in Q3 2025 with a staggered approach to cover all investors.

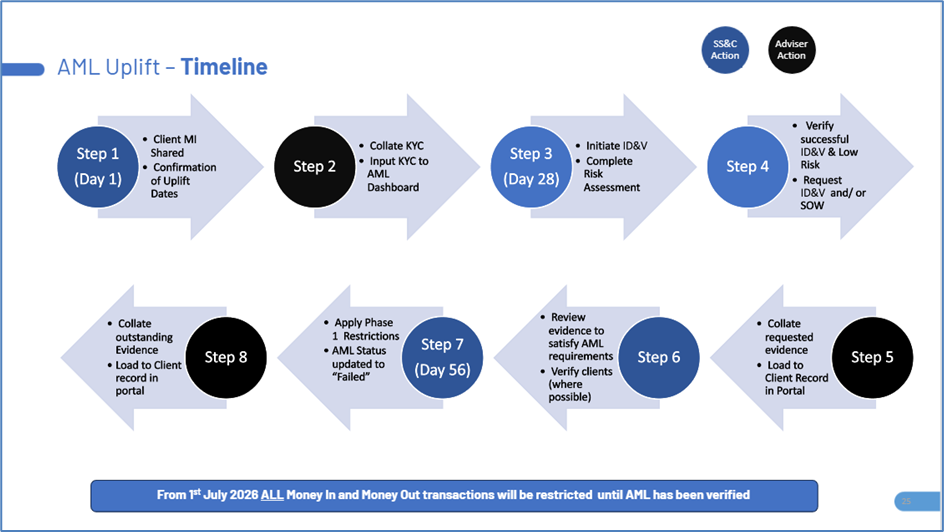

The uplift timeline is outlined in the table below.

SS&C Hubwise have built a new AML Uplift Tracker (screen shot below). The AML Uplift Tracker will display

- A full list of investors where verification is required

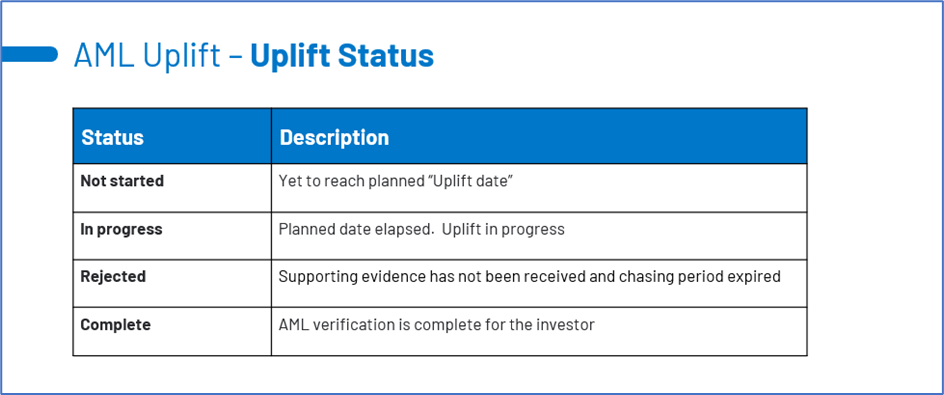

- Uplift status - See Appendix B for a full list of the AML statuses

- Targeted date for completion

- KYC data status

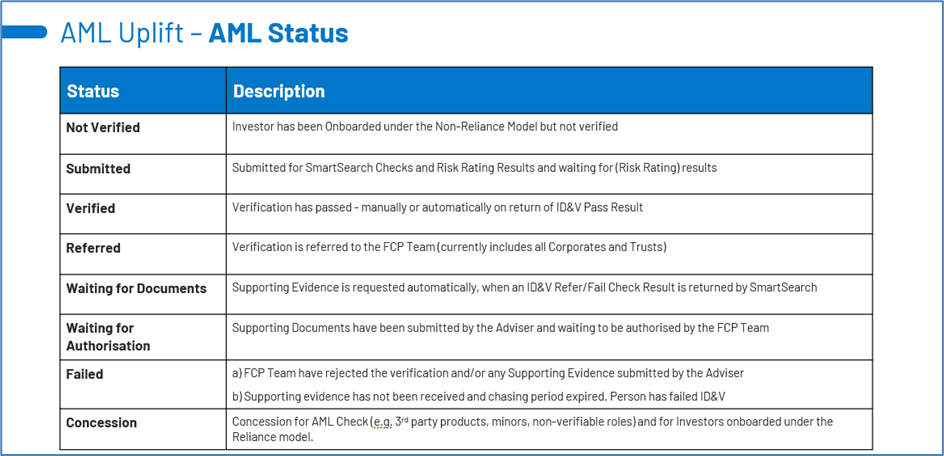

- AML status – See Appendix A for a full list of AML statuses

- Additional considerations (e.g. where the investor may be taking income)

- If any restrictions have been applied

There is a detailed AML Referral guide here - AML Referral Process : Knowledge base

When submitting documentation om the AML Uplift Tracker, it is important to upload then submit the documents. To avoid delays, please only use the AML Uplift Tracker to submit documentation (as opposed to Freshdesk/ email).

These can be added directly onto the portal via the new AML Uplift Tracker (KYC Info Required tab).

In addition to adding the new KYC information, we highly recommend reviewing the accuracy of the existing investor data (e.g. Full name/ Complete address etc). This data will be used in the electronic ID&V process. Any inaccuracies may lead to a referral. More information on Investor Data Quality can be found here – Investor Data Quality : Knowledge base

For retail investors, acceptable ID&V documentation is as follows. One document from each list will be required.

Evidence of personal identity

- Current signed passport

- Current signed UK / EEA photo-card driving licence (full or provisional), or blue disabled driver’s pass.

- Current full UK driving licence (old paper version). Paper provisional licences are not acceptable.

- Recent evidence of entitlement to state or local authority funded benefit, including housing benefit and council tax benefit or state pension (dated within the last year)

- Most recent HM Revenue & Customs (HMRC) tax coding notification, assessment or statement

- Shotgun or firearms licence

- Residence permit issued by the Home Office

- National identity card

- Northern Ireland voter’s card

- Self-employed registration cards for individuals and partnerships in the construction industry: CIS3 (partner); CIS4 (P); CIS4 (T); CIS5; CIS6

Evidence of address

- Please note the full address must be stated for the document to be acceptable.

- Local authority tax bill (valid for current year)

- Current signed UK / EEA photo-card driving licence (full or provisional)

- Current full UK driving licence (old paper version). Paper provisional licences are not acceptable.

- Solicitor’s letter confirming house purchase or land registry confirmation.

- Local council rent card or tenancy agreement.

- Recent evidence of entitlement to a state or local authority funded benefit, including housing benefit and council tax benefit or state pension (dated within the last year)

- Original utility bill, no older than 6 months (not including mobile phone bill), or a certificate from a supplier of utilities confirming the arrangement to pay for the services on pre-payment terms. Note, if your client does not receive paper copies, original PDF colour copies of utility bills are acceptable.

- Most recent HM Revenue & Customs (HMRC) tax coding notification, assessment or statement

- Bank statement (system generated) no older than 6 months.

- We will accept certified copies of original documents. We will also accept an attestation stating, “I confirm I have seen the original documentation and any photograph is a good likeness of the Investor”.

- The attestation can be completed by the adviser or any other member of your operations/ administration team.

- A single certification header sheet can replace individual page certification. It can be electronic or handwritten.

Please note that where multiple documents are required/ requested, the verification will only commence once all required documents have been submitted.

Documents should be in date, council tax and HMRC notices should be for the current tax year and no older than 6 months old. Utility bills and bank statements should be no older than 6 months. Certification should be dated after the date of the documents and no older then 6 months.

With council tax bills, If using a current tax year bill older than 6 months (e.g. issued in February, submitted in September), certification should state: “I hereby certify this to be a true copy of the most recent original council tax bill for Mr/Mrs X.”

On the AML Uplift Tracker, there will be a link through to the existing investor AML Status page to upload the evidence as per the current BAU process.

You can add multiple files (if required). They must be in the following file format: -

- jpg

- Png

Please ensure file names are less than 50 characters.

For investors included in the AML Uplift project, notifications will be sent on a weekly basis directing users to the AML Uplift tracker and highlight the investors where action is required

See question 5 for the reminder notification timeline. Automated notification emails will be sent to the registered adviser email address from noreply@hubwise.co.uk

There are no email notifications sent to the investor.

Please note that you may receive separate bank validation notifications. For new investors, we will continue to follow the BAU process for AML notifications.

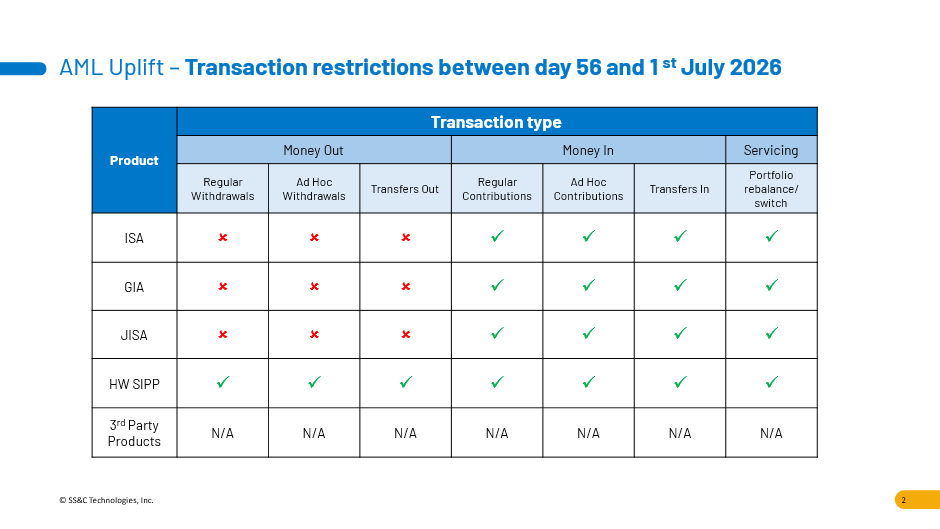

If the investor fails these AML checks (or if acceptable evidence has not been provided in the given timeframe), the investors account may be restricted. Please see Appendix C

for a detailed view of how restrictions may apply per product.

- SmartSearch for ID&V

- Napier for Sanctions and PEP screening

- GBG for bank verification

- SS&C Hubwise Risk Engine

Additional questions

Yes, these investors are included in the AML Uplift process. Please note that if you have an investor marked as vulnerable on the Investor Details screen, it is important that you complete all of the mandatory fields. Where these fields have not been completed, it will not be possible to update the KYC information in the AML Uplift tracker. You can quickly navigate to the Investor Details screen to update the vulnerability information. Please select the Investor ID link on the AML Uplift tracker.

As a reminder no notifications will be sent to the investor.

Where you are entering information for a retired investor, please select

- Occupation = “Retiree”

- Industry = “Other” (please then add “retired” in the free format box)

We have built a new set of screens to capture information on Corporate and Trust accounts. More details on the Uplift process for Corporates and Trusts can be found on the link below

AML Uplift Tracker launch – Corporates and Trusts – Client communication : Knowledge base

A list of supporting documentation for Corporate and Trust accounts can be found on the link below

AML Supporting Documentation – Trust and Corporate Matrix : Knowledge base

Please note that once a Corporate/ Trust category has been submitted on the portal, this can only be amended via a Freshdesk ticket.

The current process will be followed whereby minors are set with a “concession” status. These investors will be verified after they turn 18 years of age.

These roles will also be subject to verification in line with our current process.

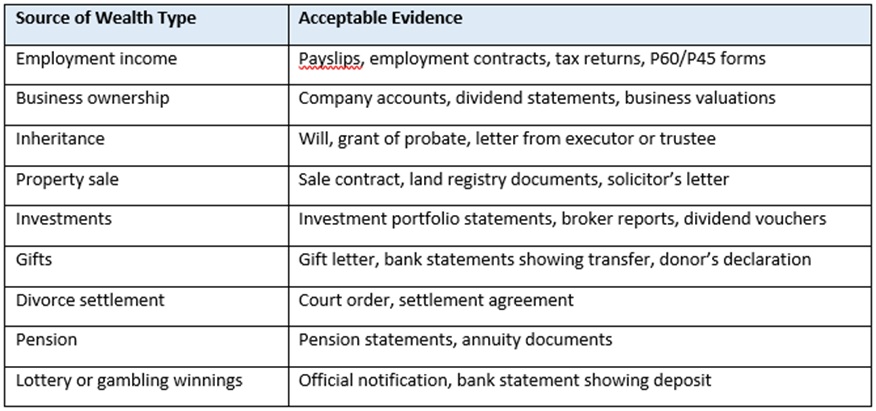

Where Source of Wealth (SOW) of investors is requested, please follow the principles and process below:

- Independence & Verifiability- Evidence must be independent, credible, and verifiable. It should directly link the investor to the origin of their wealth.

- Practicality & Relevance - Advisers should consider whether they would accept the document themselves. If so, it is likely to meet SS&Cs standards.

- Avoiding Ambiguity - Generic or vague descriptions are discouraged and may lead to requests for additional documentation.

Example acceptable documentary evidence by SOW type

Please note that the following examples are illustrative and not exhaustive; other forms of credible and verifiable documentation may also be acceptable.

From December 2025, SS&C Hubwise in line with Joint Money Laundering Steering Group guidance, will undertake ongoing AML reverification of investors. The frequency of the reverification will be based on the outcome of the SS&C Hubwise risk assessment, in line with the following:

- High risk = Annual reverification*

- Medium Risk = Every 3 years*

- Low Risk – Every 5 years*

(*assuming there is no change in status from the previous risk assessment).

Where possible, SS&C Hubwise will complete electronic ID&V without the need for adviser intervention. Where the ID&V results in a referral, we will notify you by email and request suitable supporting evidence in line with our BAU requirements.

In addition to this periodic reverification, SS&C Hubwise will always look to reverify an investor where there is a change in status such as:

- Industry or occupation

- Nationality

- PEP and or Sanction status

The aim of the reverification process is to provide ongoing oversight to combat the every changing challenges of financial crime.

If the document remains valid and unchanged, previous certification may be reused with the following attestation:

“I confirm that this identification document is still in date, we have previously seen the original and it is a true likeness of Mr/Mrs X. I can confirm that since the previous certification was completed, there have been no changes to the document itself or the investor’s personal details.”

Please raise any queries via Freshdesk. A new Freshdesk ticket type of “AML / Bank validation” is being created to filter these requests.

Appendix

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article