SS&C Hubwise - AML Uplift Tracker launch – Corporates and Trusts – Oct 2025

We are pleased to advise you of the planned enhancement to include Corporate and Trust accounts within our AML Uplift Tracker. This communication is to notify you of the changes to the online journey and the required evidence to verify the organisation and associated parties. These enhancements are targeted for a release week commencing 13th October.

It is important to understand the process/ timelines and take action. Failure to engage may lead to account restrictions being applied.

For a reminder on the AML Uplift Tracker and the stages of the AML Uplift, please refer to the earlier communications found in our Knowledge Base

SS&C Hubwise – AML Uplift Tracker launch – Action Required : Knowledge base

As there can be multiple Corporate and Trust types, we have built dynamic user journeys where users will only be presented with relevant fields and requests for information. In order to protect you and the underlying investors, it is important that SS&C Hubwise have a clear understanding of the Trust/ Corporate structure and the individuals or organisations with controlling functions. While this information will be unique to each Corporate and Trust account, the data fields and required evidence should be consistent with industry standards on KYC (Know Your Customer).

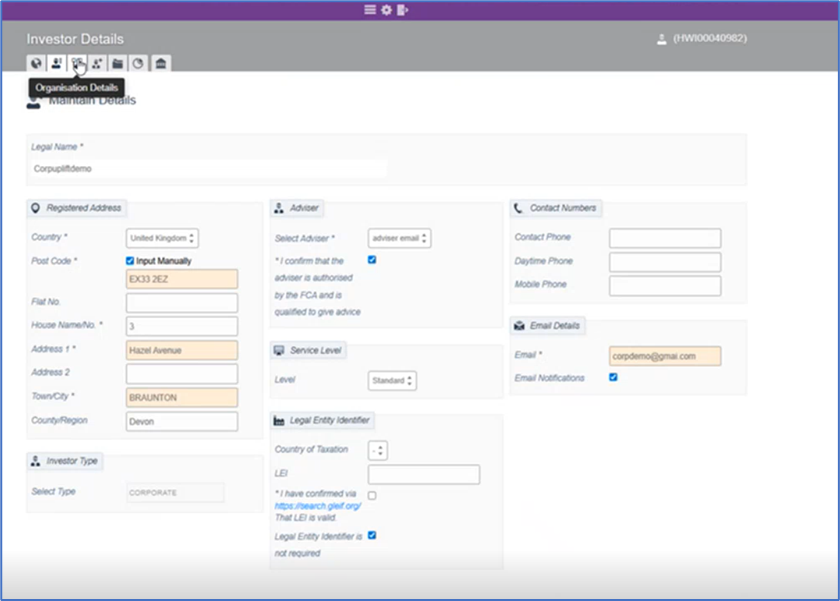

Addition of KYC - “Organisation Details”

Changes have been made to the “Create Investor” user journey. Where the Investor type is recorded as a Corporate or Trust, a new tab will appear – “Organisation Details”. This new tab will also appear on the Investor Details screens for existing Corporate and Trust investors.

Fig 1

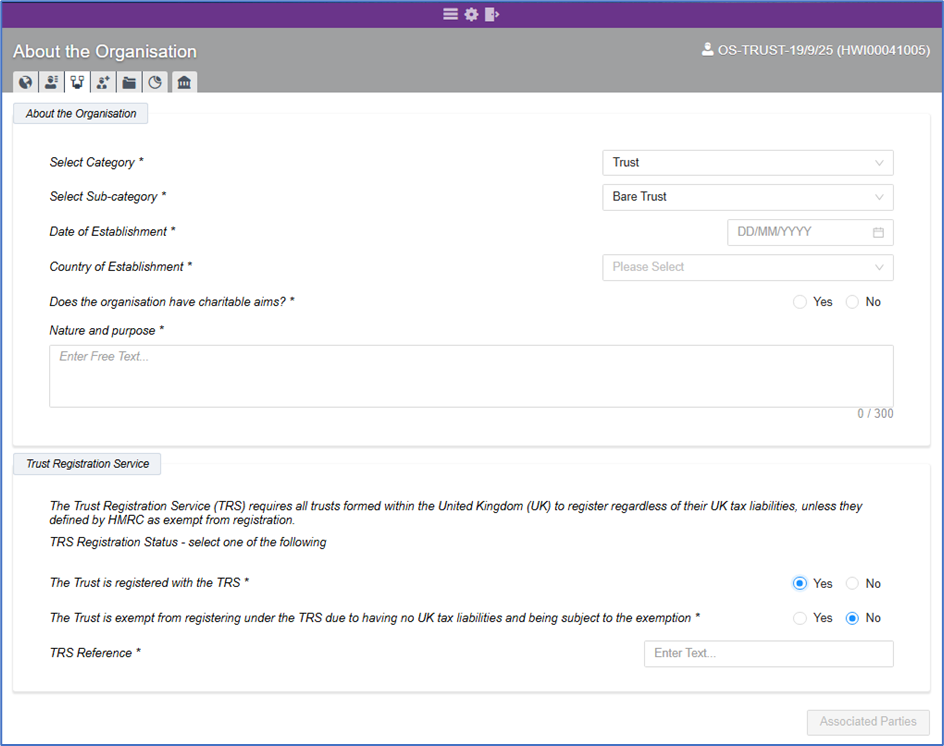

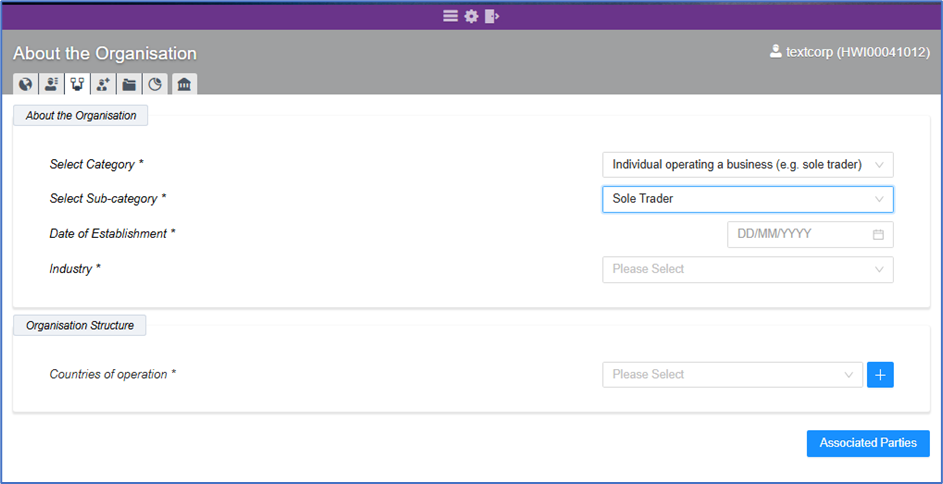

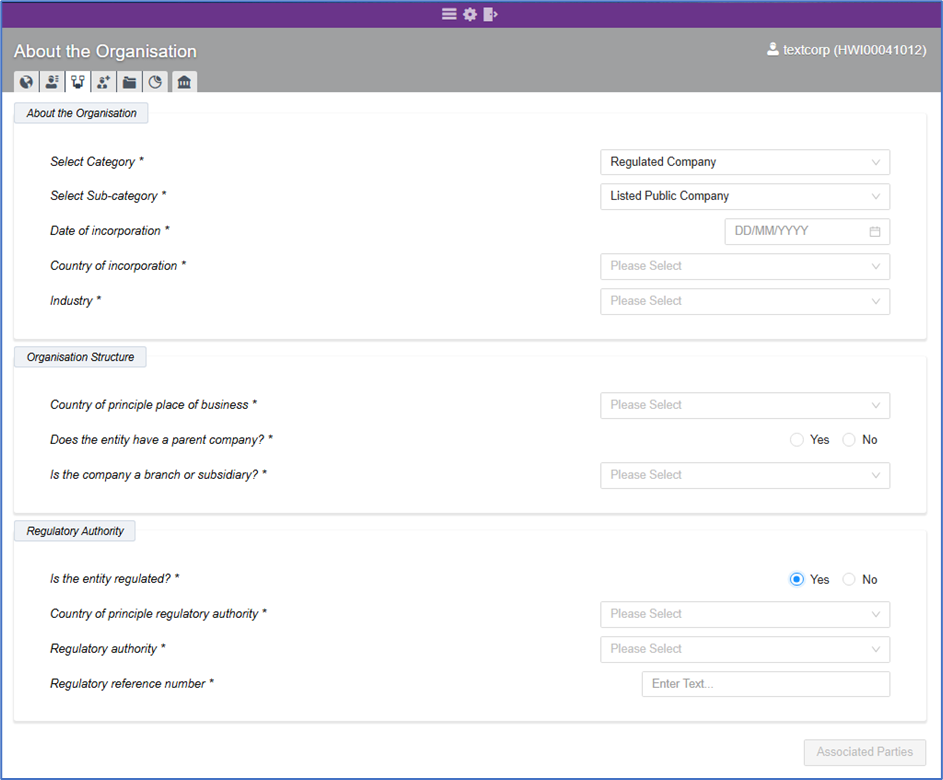

Once the Organisation Category and Sub Category have been entered, the page dynamically displays further options based on the relevant Organisation Structure, such as Regulatory Authority or Professional Register (Examples - Fig 2 – Fig 4).

The information entered here will define the associated parties entered into the next screen, and the evidence that will be required to complete the investor AML verification.

It is important that all Associated Parties referenced in any organisation documentation (e.g. trustees in a trust deed or controlling directors in a corporate entity) are recorded against the Organisation.

Fig 2 – Example - Bare Trust

Fig 3 – Example - Sole trader

Fig 4 – Example - Listed Public Company

Addition of KYC – “Maintain Associated Parties and Organisations”

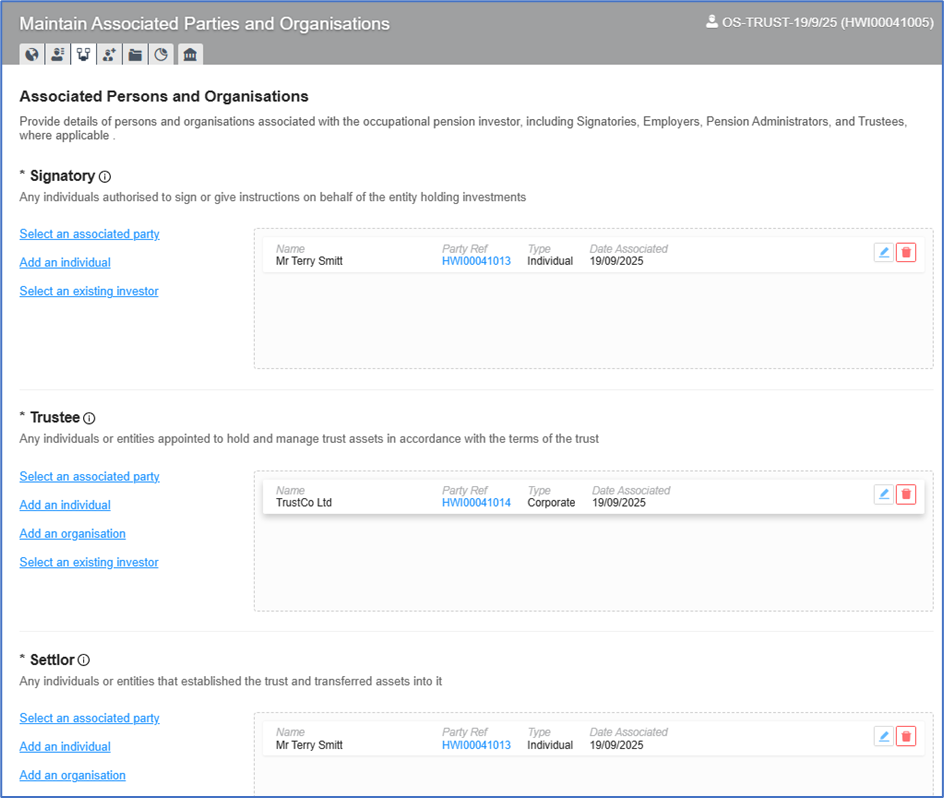

On completion of the Organisation KYC fields, you will be asked to add the details of all relevant associated individuals or organisations including Signatories, Ultimate Beneficial Owners and Persons of Significant Control. A tool tip next to the associated party heading will highlight where this information is mandatory (See Fig 5). Note that an individual or entity could have multiple role types and can therefore be added under multiple sections.

Fig 5

Under each section you will be asked to link an individual or associated party. Depending on role type, there are four options (blue links) on the left hand side

- “Select an existing investor” – Select this option for an individual or organisation already recorded on SS&C Hubwise. It is possible that an existing investor may already be AML verified as part of the AML Uplift of individual investors.

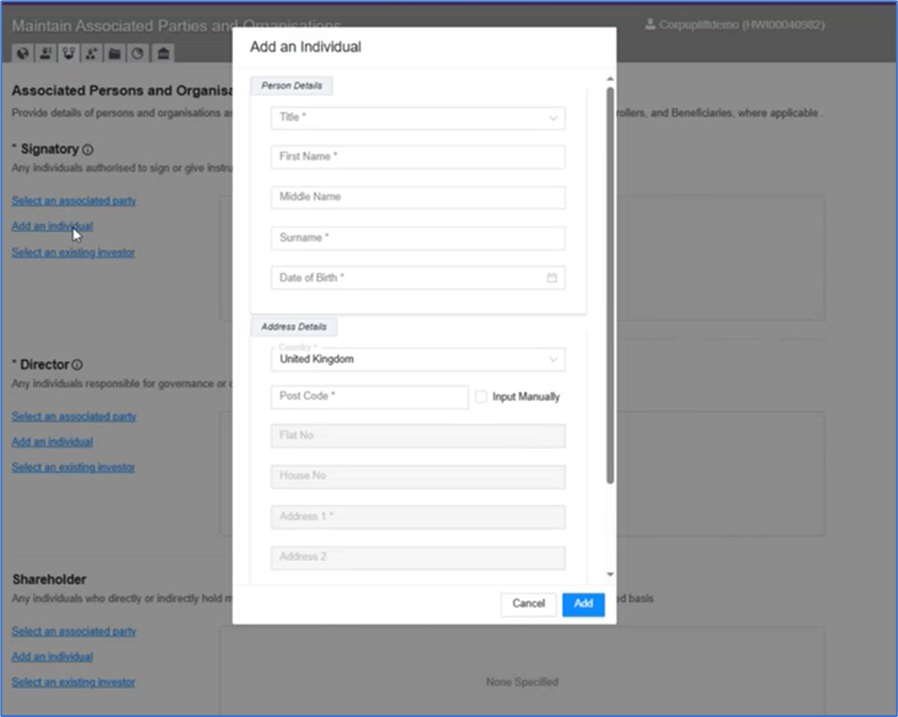

- “Add an individual” – Select this option to add a new individual and complete the required fields in the pop up - Fig 6

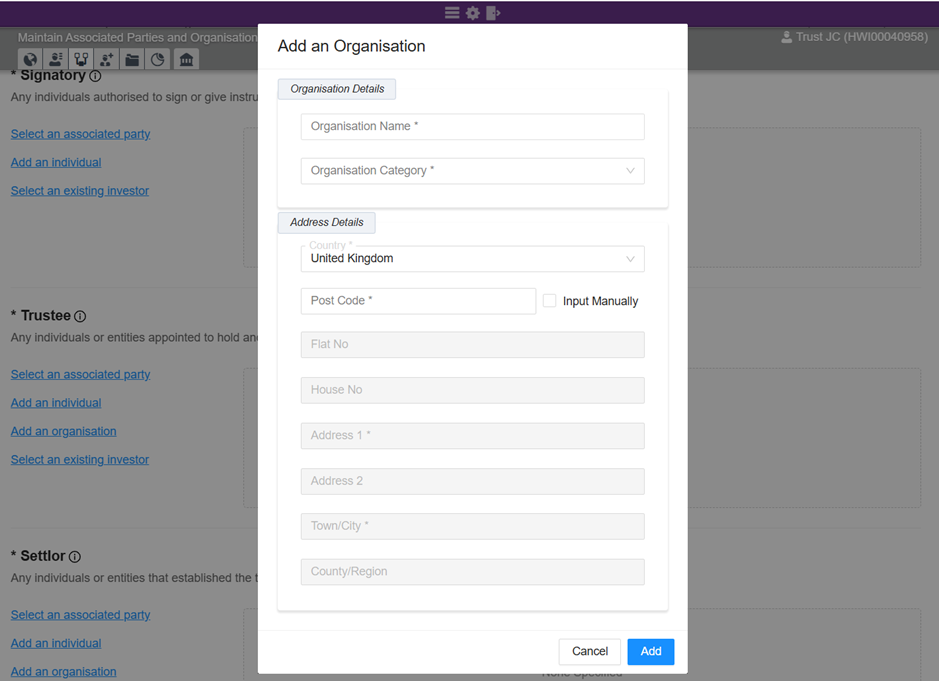

- “Add an organisation” – Select this option to add a new organisation and complete the required fields in the pop up - Fig 7

Fig 6

Fig 7

SS&C Hubwise KYC verification

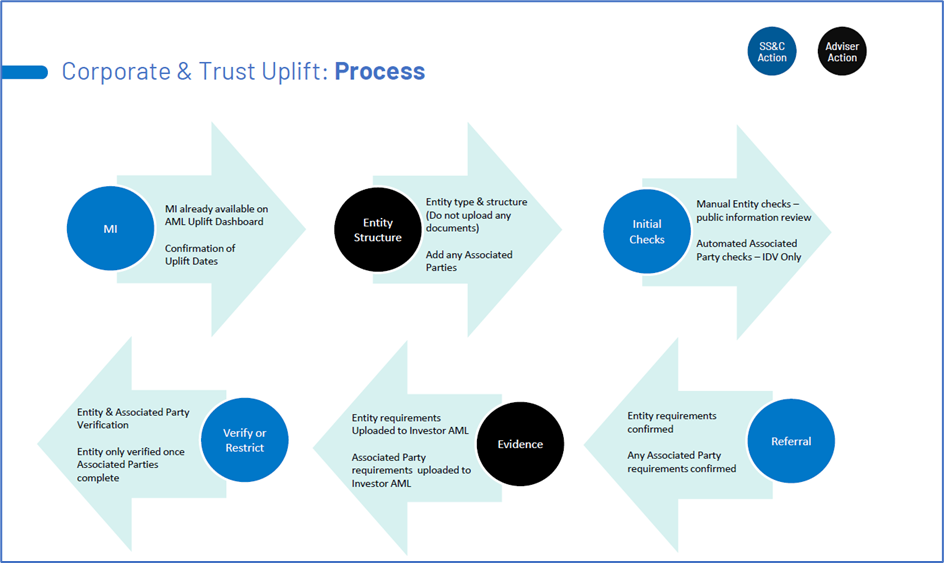

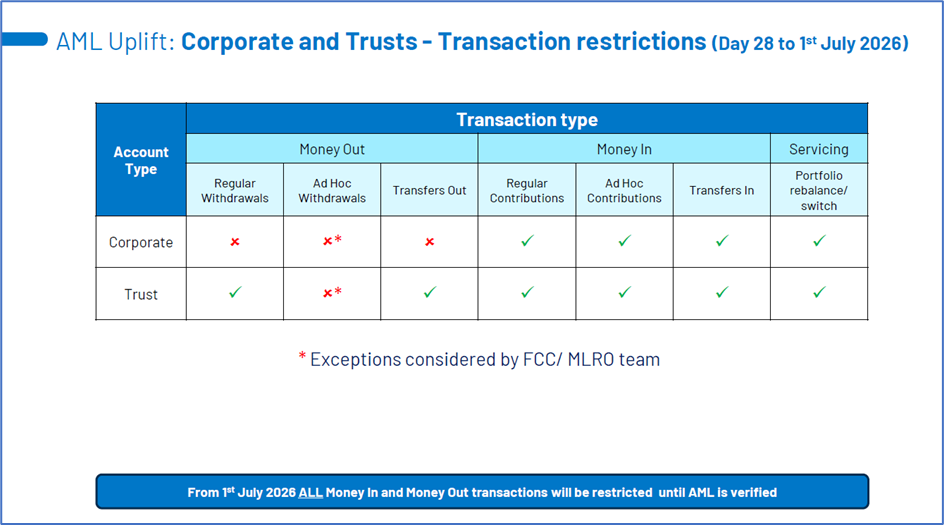

Once stages 1 and 2 are complete, SS&C Hubwise will pass all Corporate and Trust investors through verification on a tranche by tranche basis. This is consistent with the steps and timelines of the AML Uplift process for individual investor types (Fig 8a and Fig 8b).

As the tranches of Corporate and Trust investors go through the KYC verification process, all cases will lead to a referral for the Corporate or Trust entity. The referral notification (and AML Uplift tracker) will be able to highlight the status of each investor and the specific evidence required. Associated Parties will go through the Individual Uplift process - any Associated Parties that have been uplifted through the Individual Uplift programme will automatically carry over their AML Status.

IMPORTANT: While you may have the necessary documentation ready, we would ask that you wait until you receive the referral notification with the specific evidence required. This will help manage volumes and reduce delays if incorrect evidence is provided. Please do not upload supporting documents to Investor Documents (Documentation uploaded here is not passed to the Financial Crime Prevention Team)

Fig 8a

Fig 8b

Use AML Uplift Tracker to review status and provide evidence

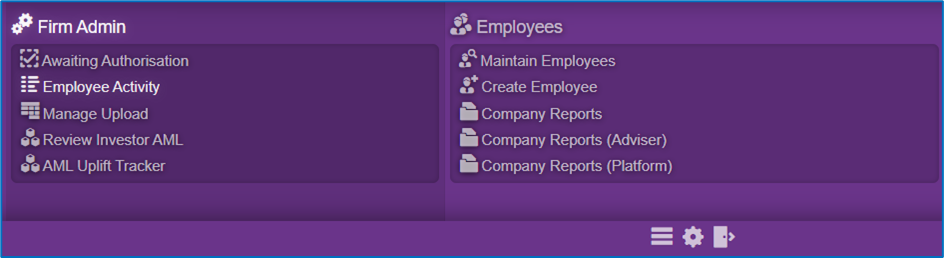

To review the AML Uplift status of all accounts, you can access the AML Uplift Tracker in the Firm Admin Menu (Fig 9)

Fig 9

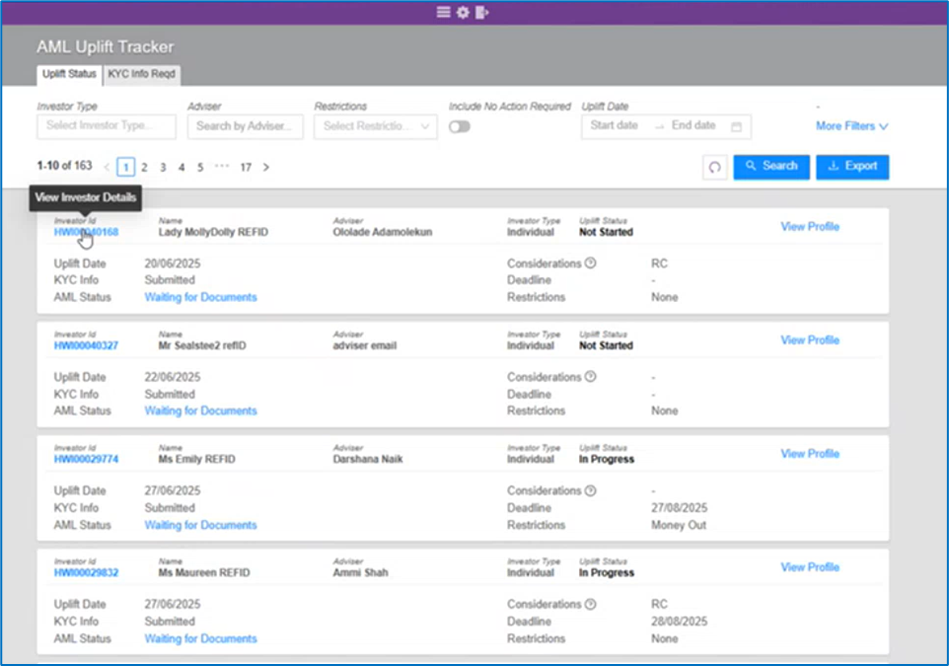

To view the information on a Corporate or Trust Account please click on the investor ID link highlighted in Fig 10.

(For Trust and Corporate accounts please ignore the KYC Info Required tab. Stages 1 and 2 in this guide highlight how this is stored differently for Corporate and Trust investors).

Fig 10

This will take you to the “About the Organisation” details screen as highlighted in Fig 2 – Fig 4 .

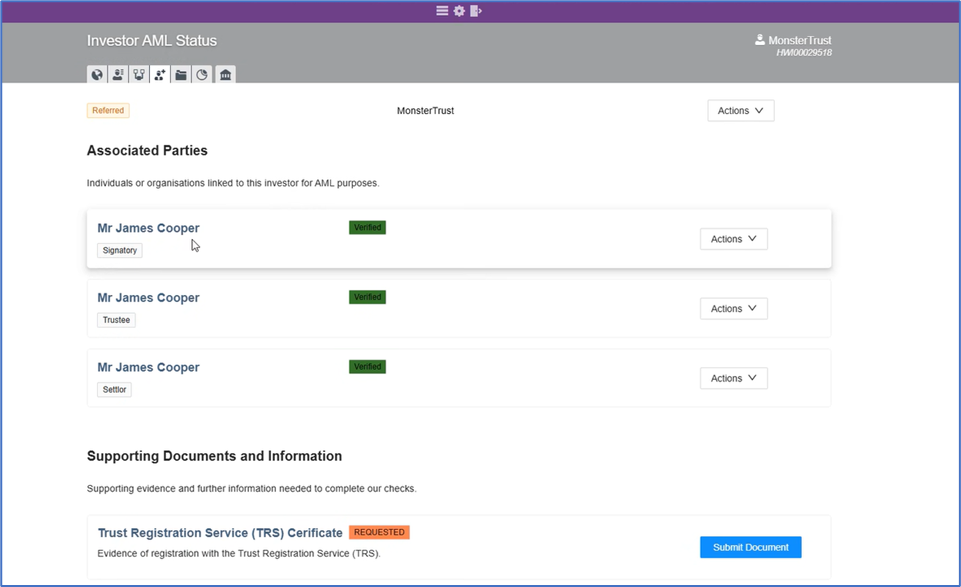

The next tab along in the menu bar will show the “Investor AML status” which will display the AML status of the Corporate or Trust investor as a whole on the top line (the example in Fig 11, shows a “Referred” status in the yellow box for the Monster Trust). This page will also display the AML status of all individual Associated Parties. Using the “Actions” drop down on the right, you are able to view and upload the specific evidence required for this Associated Party.

Fig 11

Next steps and notifications

We recommend that you continue to review the AML Uplift tracker to review the status of all investors.

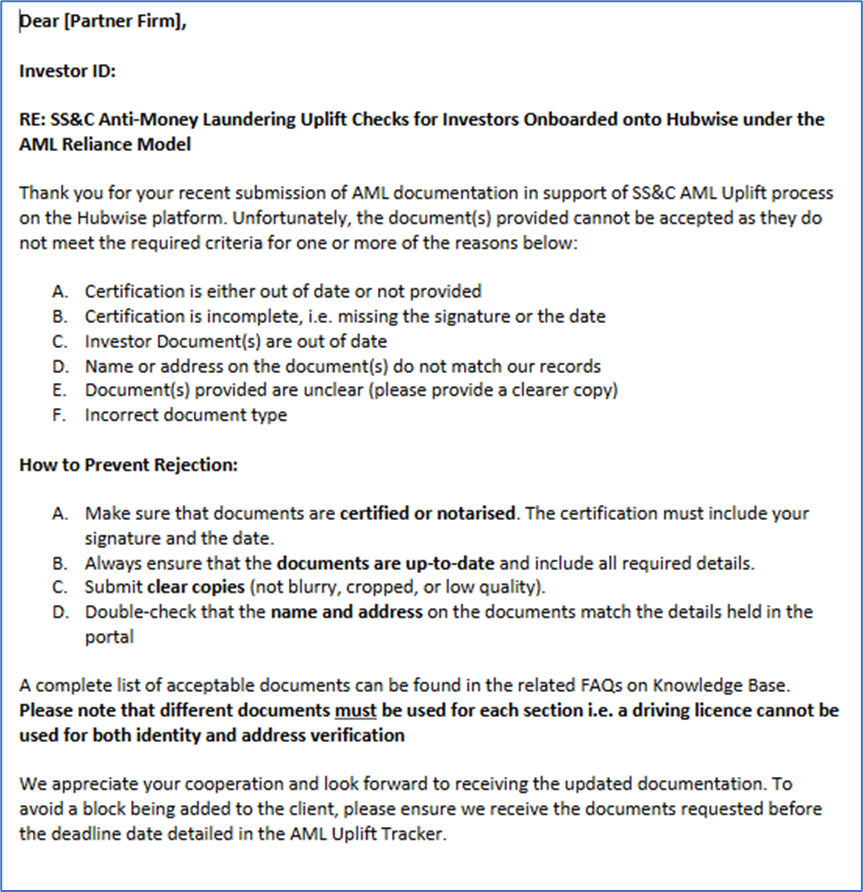

If there is an issue with the evidence provided, you will receive an email similar to the example below. Please note that notifications are sent to the recorded adviser contact. The investor will not receive a notification.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article