Multi Investment Strategies (MIS) – Adviser User Guide

The Multi Investment Strategy (MIS) functionality will allow investors’ funds to be invested in a model that holds one or more sub-models.

MISs are available for SIPPs, GIAs & ISAs

There are 2 main ways in which MISs can be used:

1. One MIS can hold several sub-models.

2. One MIS can hold a combination of sub-models and single ISINs.

Structure of a MIS account and terminology:

Primary account - The overarching account is known as the Primary Account - this account will generally not hold any investments; it has a £0 Cash/Market Value.

Any contributions coming in will be proportionately (based on the weighting allocation assigned for each sub-model) split and swept into the sub accounts automatically to get invested (except for BPS models).

Example portal screen showing primary and sub accounts

There are 2 options to set up a MIS account:

- Create the MIS model before opening the account and select that MIS model in the Application journey. This option allows you to create an MIS Structure that could be used for multiple investors/accounts.

- Create the MIS model during the Application journey which will be bespoke to that investor account.

Setting up a new MIS model

To create an MIS can be done in the same way that you currently create standard individual or bespoke models.

Log into the portal via your IFA environment and proceed to the Model Maintenance Dashboard:

Select ‘+ New Model’

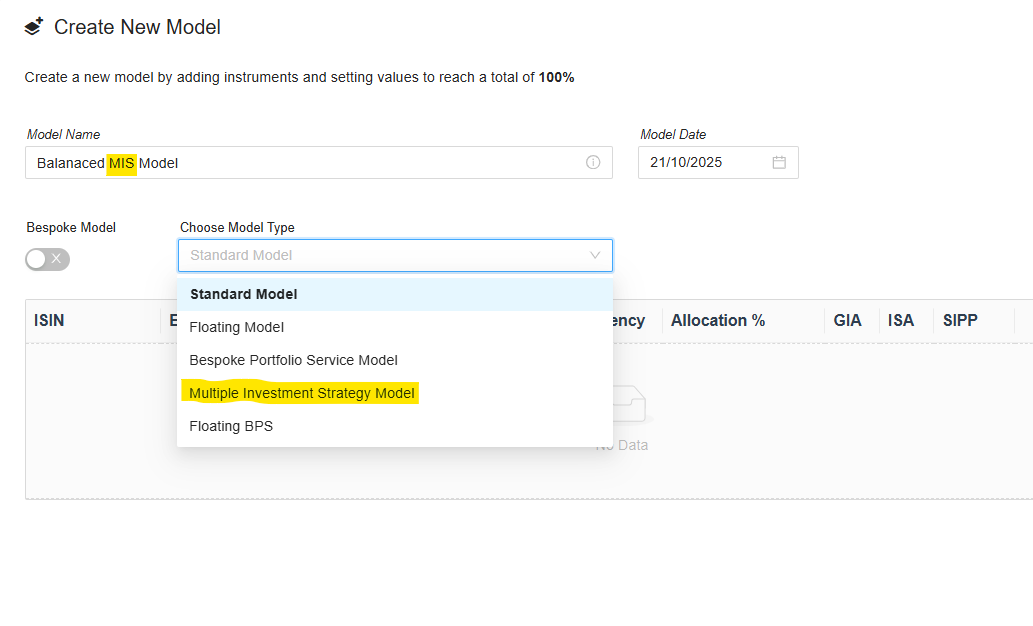

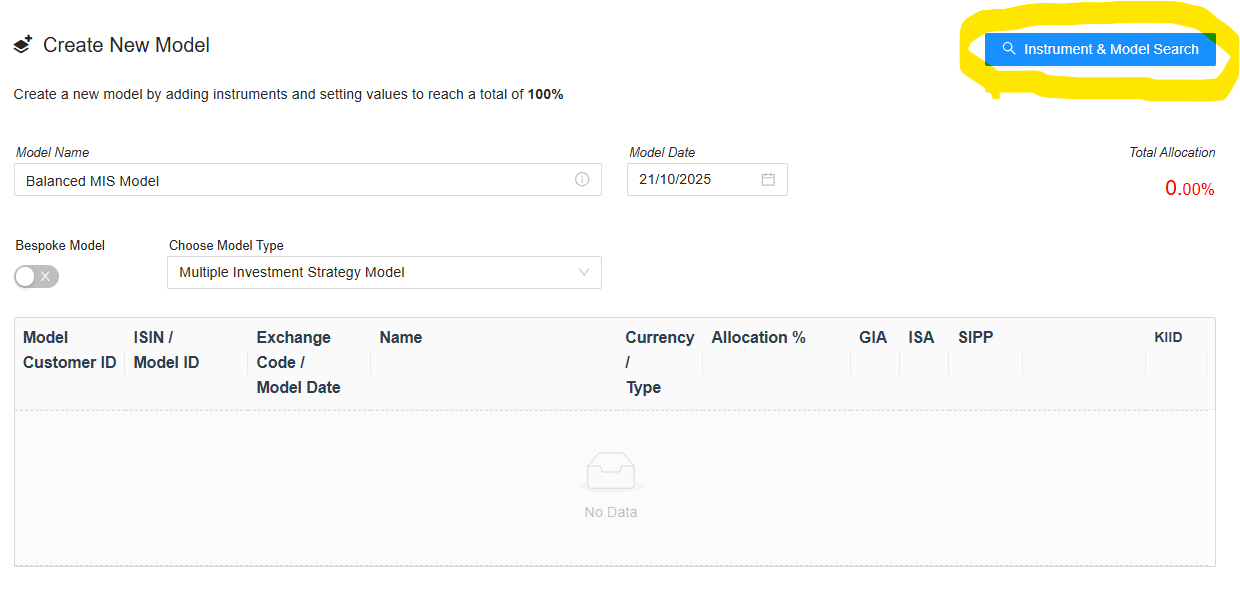

Select the Model Type as ‘Multiple Investment Strategy Model’ and enter the model name (we recommend you use MIS in the model name).

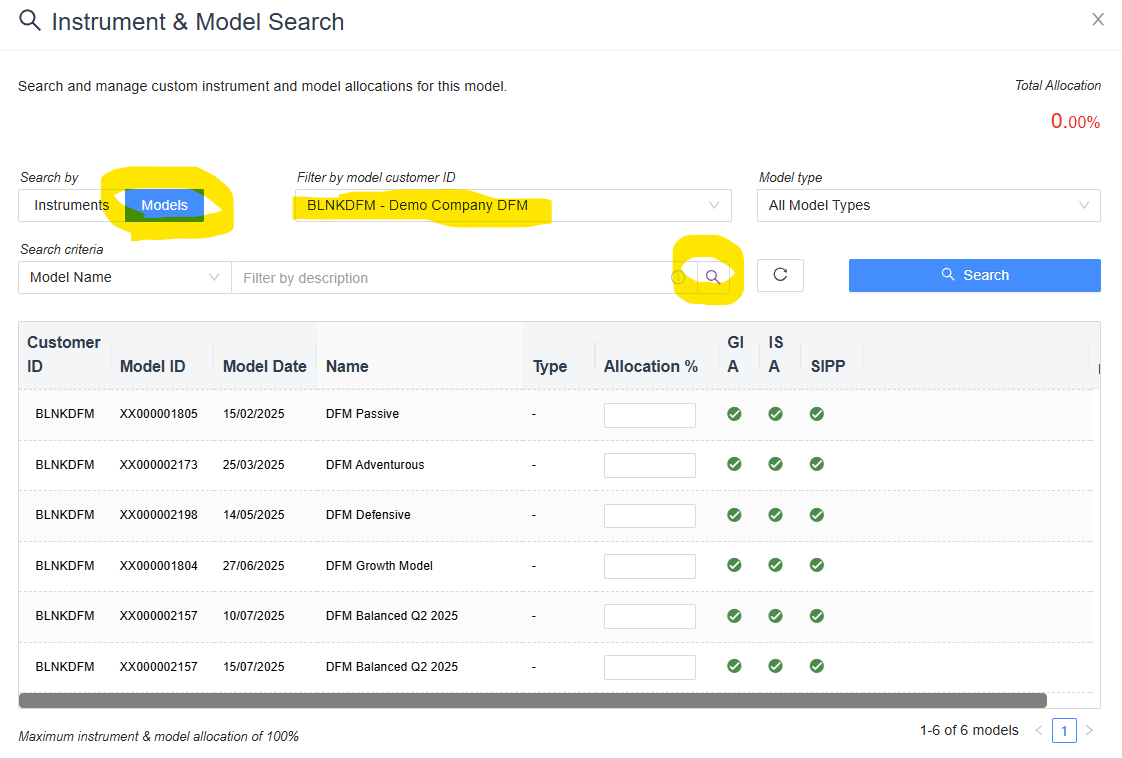

You the select instrument & model search and the select search by models and then search and you will see all of the current Company and all the Managed (DFM) models available to you that can be selected.

Select all the model portfolios required to create the MIS model by allocating a % to each of the model portfolios to be included.

To add the individual ISINs to the MIS model, click on ‘Search by Instruments’ then you can click on ‘Search’ to view all the instruments available. Or you can use the Search criteria to select a required ISIN.

One the allocation is complete close the Instrument and Model Search view and click to create the model portfolio.

The model will be set to inactive, and you will need to click on ‘Show revision’ to make this visible in the portal.

Setting up a new MIS Account

Note: By default the minimum investment to set up an MIS account is £150,000.

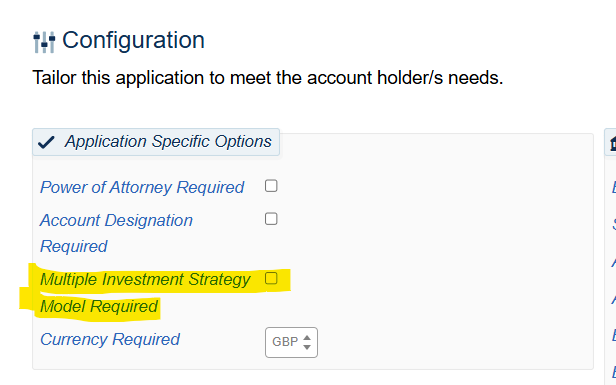

One the first page of a new account application select the Multiple Investment Strategy Mode required option.

When you get to the investment portfolio section of the application, the only models that will be visible will MIS models already created. These could be company MIS Models or Managed MIS Models where a DFM has created them.

Where you wish to create a bespoke MIS model you can create this using the Bespoke Model option and following the steps earlier in this guide.

Once the application is complete and submitted the Primary and Sub Accounts will automatically be created and will be visible in the portal.

Go to the ‘Account’ screen of the primary account, you can view the MIS model that is linked to this account

The MIS and each sub-account will be reflected in separate tabs across the top. Go to each sub-account and you can view the sub-model linked to each sub-account.

MIS Primary Account Characteristics

- Will appear as a box overarching the sub-accounts in the portal

- Multiple Investment Strategy Model will be indicated in the summary.

- No investments will be held at this level.

- Account top-ups will be applied to the MIS and then apportioned accordingly across the sub-accounts.

Sub-Account Characteristics

- Will appear as a box underneath the Primary Account in the portal.

- Buying power will be applied to each sub-account

- Fees will be charged to each sub-account

- A cash balance will be held on each sub-account

All individual ISINs (where applicable) that have been included in the MIS, will all be grouped into one sub-account. This will be indicated as ‘NO Model’ in the sub-account summary:

MIS functions

The MIS will show on the client’s investor screen in the following format

The account navigation buttons can be used in the same way as a standard account at the MIS level or individual sub-account level.

Once you click on Performance, Account, Portfolio, Statements or Transactions, the relevant page will be displayed containing the investment information. These options can be viewed for the MIS and each sub-account individually via the button on the relevant sub-account or MIS.

The MIS and each sub-account will be reflected in separate tabs across the top:

Transfers In

Transfers in, whether cash or in-specie should be added to the account in the usual manner via the portal against the primary account.

Cash Transfer

Cash Transfers In should be added to the account in the ‘Transfers’ section in the MIS Primary account. Once the money hits the account, it is proportionately split and swept into the sub-accounts to get auto invested (except for BPS models).

In-Specie Transfer

- Instruct an in-specie transfer (Re-registration) on the Primary account using ‘Add/Amend contributions’.

- The Holdings and cash would commence transfer from ceding party into the primary account.

- Once the transfer is complete, any Cash is automatically proportionately swept into the sub-accounts and get invested (except for BPS).

- The Holdings will stay in the primary account awaiting and will not be automatically moved to the sub accounts.

- You will need to use the ‘Investment instructions’ (this is a specific portal permission users will need) to move the Holdings from the primary account to the sub-accounts as required.

Top-Ups

Any regular payments or one-off deposits to the MIS primary account can be actioned via the Portal.

Note: We are currently allowing top ups and regular contributions to be made against a sub account, so they invest directly into that sub account. This function is only available for GIA and ISA. We will remove this functionality when we enhance the MIS functionality to be able to nominate which sub accounts contributions are to be allocated to

Model Rebalancing and Invest Surplus Cash

There is the ability to invest surplus cash or rebalance at the sub-account level (NB - Rebalancing is not permitted for a floating model or where the model is managed by a DFM)

A model rebalancing can be completed via the following icon on each sub-account within the portal:

An Invest Surplus Cash can be completed via the following icon on each sub-account within the portal:

MIS Withdrawals

The automated one-off or Regular withdrawals can be instructed on the portal by the IFA at MIS primary account level or individual sub-account level (GIA and ISA only). The ability to do this at sub account level will be removed in the future when we introduce the ability to specific the sub account(s) that withdrawals are made from.

Primary account level:

When a single or regular withdrawal is instructed on a primary account level, then then sell downs will be in line with the MIS model splits (as per the MIS model) from the sub-accounts and the cash moved to the primary account to be paid t the investor.

Go to the ‘All Account Actions’ cog on the primary account and click on ‘Withdrawals’.

Drawdown

Drawdown can be instructed on MIS accounts and funds will be sold down as per the MIS Model split.

Fees and charges

All fees, charges and buying power will be applied to each sub-account.

The MIS primary account will not hold any cash or have any fees and charges applied.

Ongoing Adviser charge changes:

Please note that any ongoing Adviser charges are held at both primary and sub accounts but updating the ongoing charge at primary account does NOT update the sub accounts. When changing ongoing adviser charges on MIS accounts, this should be done at primary and all sub accounts. We plan to enhance in this process in future so that changes to ongoing adviser charges can be done at primary account which will automatically update the sub accounts.

Investment Instructions

The ‘Investment instructions’ function can be used to perform various actions on the MIS accounts:

• Raise an amount

• Invest an amount

• Buy an ISIN (not available on DFM models)

• Sell an ISIN (not available on DFM models)

• Transfer cash between the primary and sub-accounts

• Transfer ISINs between the primary and sub-accounts

• Transfer ISINs between sub-accounts and primary (not available on DFM models)

• Create a sub-account (available only at the primary account level)

Notes

This is a permission-based function, please contact your Superuser or Hubwise Customer Services to enable this permission for an employee.

Go to the ‘All Account Actions’ cog and select the ‘Investment instructions’, this is available at both the primary account level and the individual sub-accounts level.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article