DFM Guide - Multiple Investment Strategies (MIS)

Multiple Investment Strategies

Hubwise allows the ability to hold more than one portfolio within an account/product which we call Multiple Investment Strategies (MIS)

This is achieved by having a Primary Account where money is deposited and sub accounts where the money is invested and where the individual model portfolios are held.

The set up of an MIS account is achieved when the adviser selects an MIS Model when setting up an account/product.

MIS Models

An MIS model can be created by an adviser firm and can include model portfolios form any of the DFMs that the adviser has access to. Where the adviser does there is nothing for the DFM to do as the individual models are still managed but the DFM.

A DFM also can set up an MIS model compromising one or more of their model portfolios should they choose to do so. This could be combining both active and passive models in various combination where both are offered.

Where a DFM wants to do this then a model portfolio needs to be created.

Creating an MIS Model

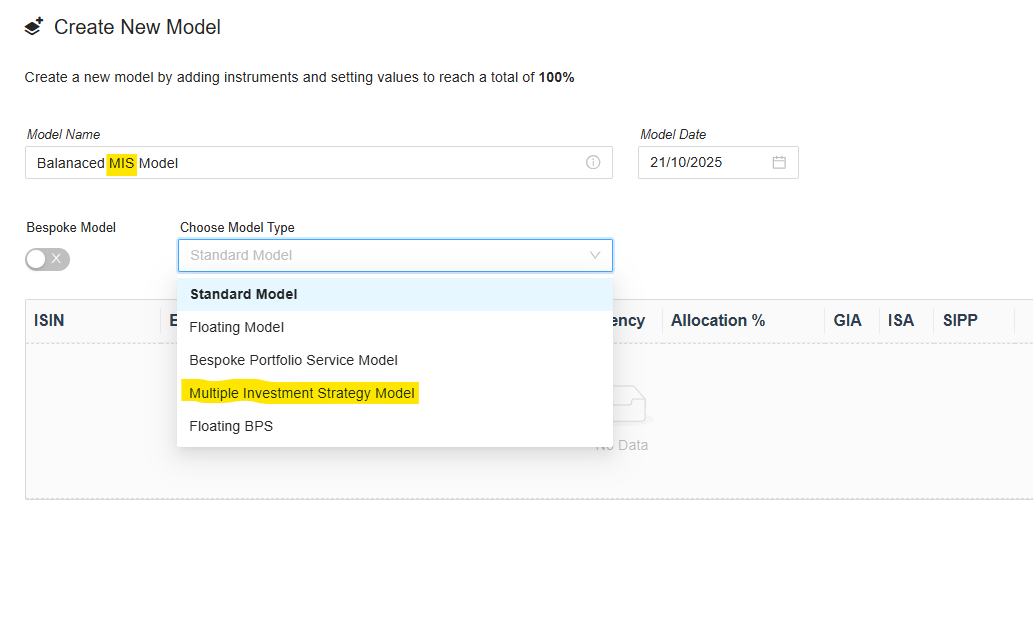

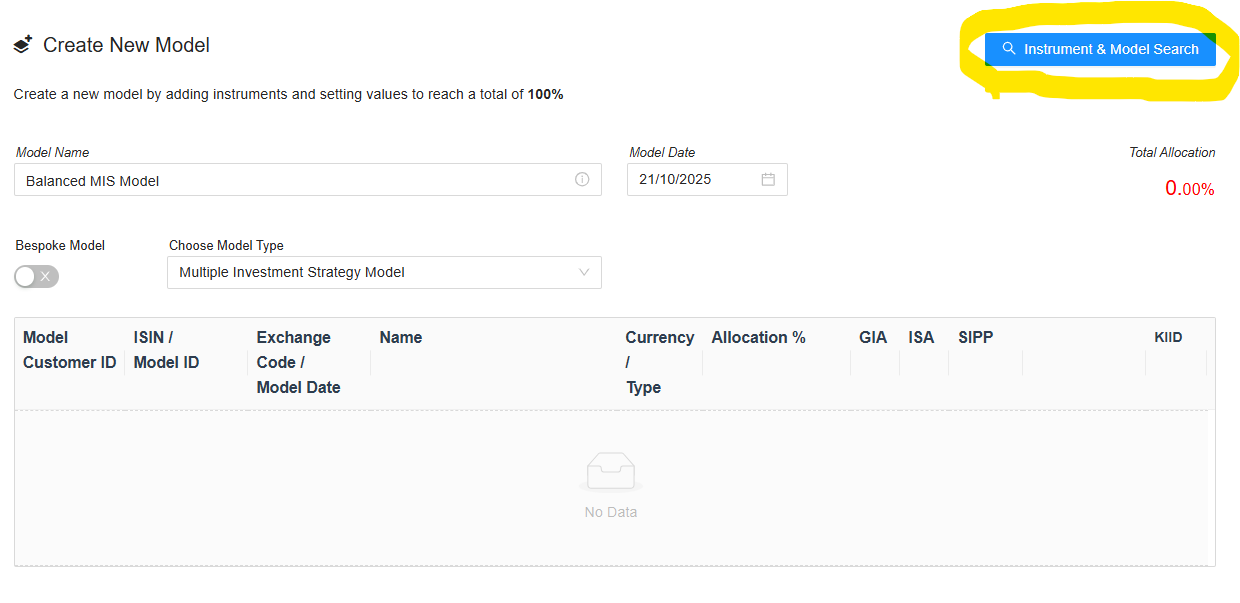

The model type needs to be Multiple Investment Strategy Model. We suggest you also include MIS in the title of the model so it’s obvious it is an MIS model.

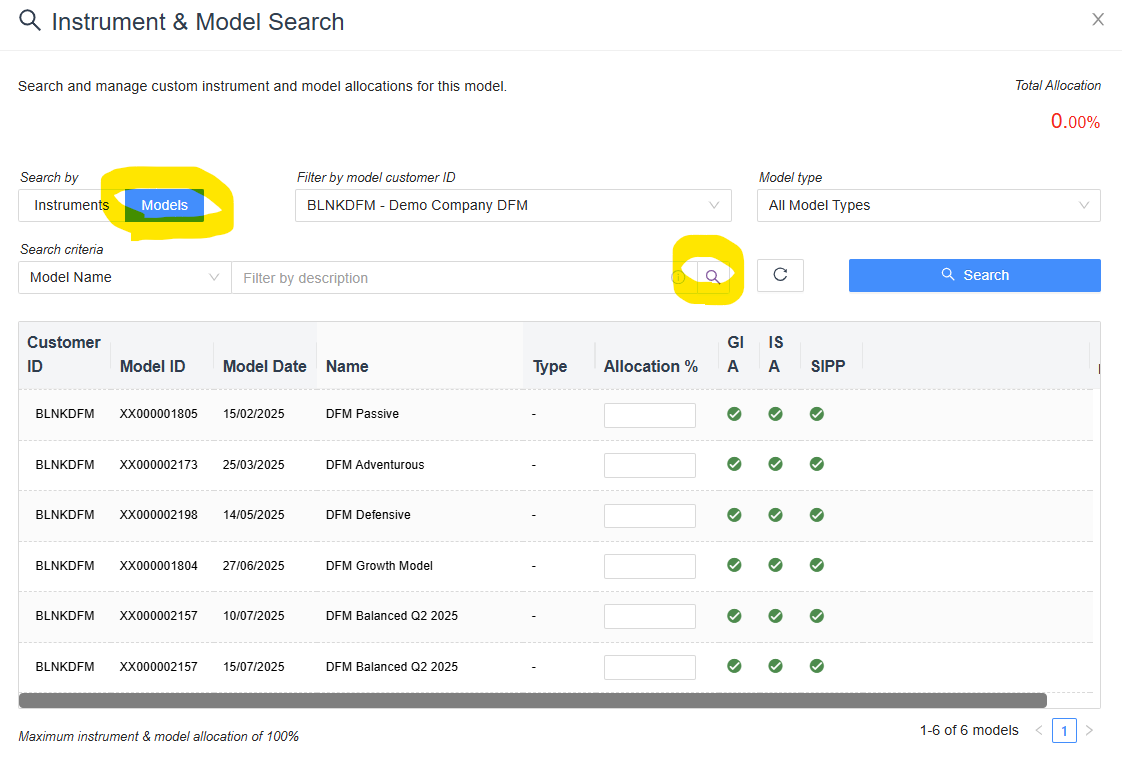

You can now allocate a % to the models to be included in the model and then create the model in the usual way. The model will then need to be made visible (show revision) in the usual way.

Managing an MIS Model

Once created there is no need to manage the model on an ongoing basis that the components of the model will be managed in the normal way. The MIS model is only selected to set up accounts/products with an MIS structure.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article