In line with HMRC guidance, all redress payments must be treated as relievable pension contributions. This applies whether compensation is paid directly to the client (who then contributes to their SIPP as a personal contribution) or paid directly into the SIPP by us as a third-party contribution.

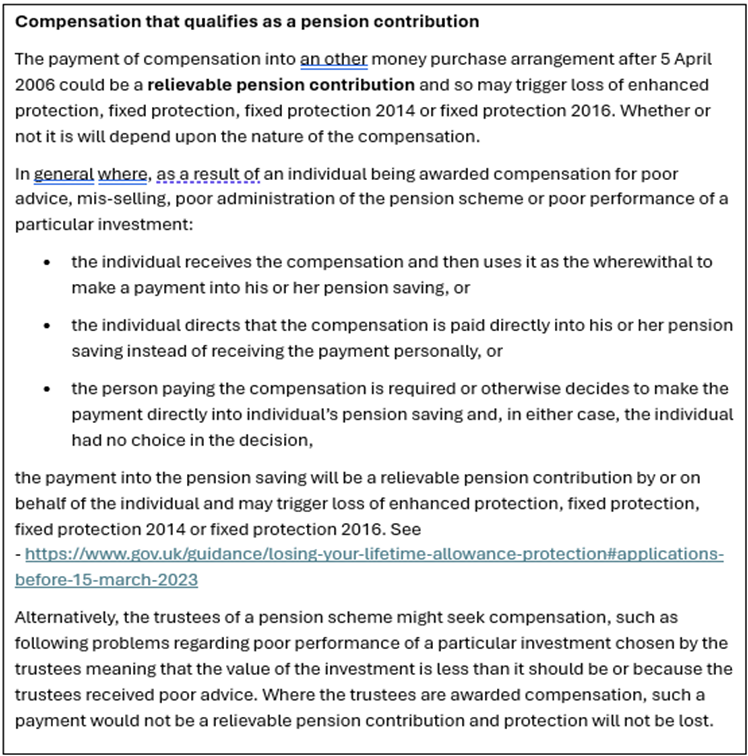

Here is the extract from HMRC that supports treating ‘compensation’ payments as relievable contributions.

Our standard practice is to pay compensation directly to the client, rather than crediting the SIPP as a third-party contribution. This approach helps mitigate the risk of breaching the client’s Annual Allowance or exceeding their relevant UK earnings, which could result in loss of tax relief or additional tax charges.

HMRC does stipulate some limited circumstances where a payment can be made directly into a SIPP without being deemed a contribution. An example would be where an element of a fee is regarded as unearned due to the service to which it relates as having not been delivered. In this scenario a fee refund into the SIPP could be permitted but each case would need to be considered on its own merits.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article