We have an over-arching agreement with Countrywide Assured Limited so that our IFA Firms can access The Onshore Bond product: Onshore Bond | CountryWideAssured

You must also enter into an agreement with Countrywide Assured Limited for the Product to be available to you. We will assist with an introductory meeting with Countrywide where the steps can be discussed and agreed.

Once you have an agreement in place with Countrywide, we will enable the configuration of your Portal to include The Onshore Bond Product and confirm to you when done. You will then be able to open new Onshore Bonds, and transfer-in any existing Bonds which are currently held with other Custodians.

- You must complete The Countrywide Assured Onshore Bond application form and send into them, following their instructions and guidance.

- Money in and out of the Bond must be via Countrywide Assured’s bank account. When you open The Onshore Bond in the Portal you must add Countrywide’s bank details to the Account record, and NOT those of the investor. These bank details will be validated against our back-office records.

- Money in can arrive via electronic transfer or cheque and must be sent directly to The Onshore Bond Provider.

- The minimum initial investment is £50,000, and additional contributions are a minimum of £1,000.

- Countrywide will supply the illustration which includes their product fee, and all other relevant fees.

- Ensure that you can see and select The Onshore Bond product in your Portal. Your Platform Operations/ Support Team will be able to assist you and add the product to your view if necessary.

- Open a The Onshore Bond wrapper/ account in the Portal.

- Ensure that the contribution expectation is as accurate as possible- and considers the fact that The Onshore Bond provider will be taking fees before money is sent to the Platform for investment.

- You should complete the transfer section of the online application User Journey so that we have an expectation of the money that will be ultimately sent over from Countrywide- once they have received it from the existing Custodian and processed it through their systems.

- However- Countrywide will initiate the transfer request, so you can ignore the Transfer Authority Form. SS&C Hubwise will not be dealing with this transfer work.

- Initial Adviser fees, and initial product fees are taken ahead of money reaching the investor’s account- so DO NOT enter these on the portal.

- Ongoing Adviser Charges (OACs) and ongoing product fees are taken by the Provider on a Quarterly basis, so DO NOT enter these on the portal, but NOTE- these should be entered on the Provider’s application form where required.

- Platform fees (and DFM fees if applicable) are applied to the investor accounts monthly in arrears, via Portal functionality as usual.

- Once the account has been submitted and authorised, please raise a Freshdesk Ticket requesting that we rename the account as follows: “The Onshore Bond SN12345 Initial/Surname of investor”

- It is the IFAs responsibility to advise Countrywide Assured of the SS&C Hubwise Account ID so that this can be used as a reference when money is sent to us for investment.

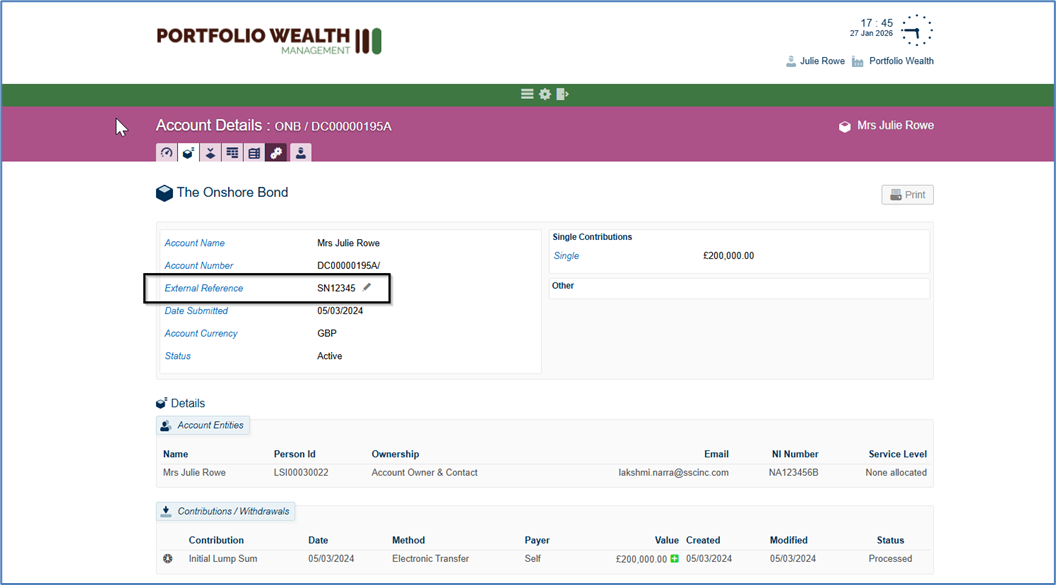

- Countrywide Assured will provide you with their Fund reference number in the format SN12345. (NOTE: do not use the client’s policy number)

This is a vital step to ensure that Countrywide Assured receive the Valuation information they need. If you do not do this Countrywide will require you to provide them with Valuation information manually. Please ensure you do the following as soon as the Account is opened:

- Add The Onshore Bond Fund reference number (SN12345) to the Account Details screen “External Reference” field on the Portal:

This section covers how you can send money to Countrywide Assured to ensure that they have sufficient cash to pay their Product fee and your OAC.

- You will receive quarterly payment notices from Countrywide Assured. These are required to replenish their Bank account to pay all relevant fees.

- NOTE: SS&C Hubwise pay these fees to Countrywide as part of their monthly in-arrears fee payment run.

- You must instruct the payment in the Portal as follows:

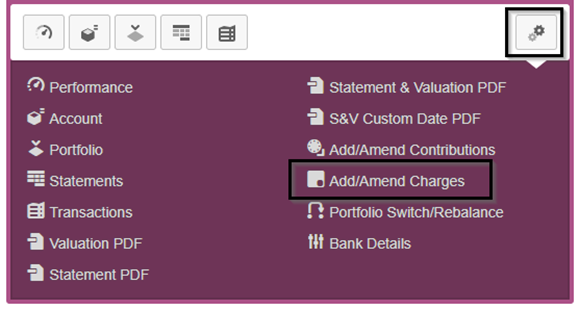

- Go to your investor’s Onshore Bond Wrapper, and in the All-Account Actions cog, select “Add/Amend Charges”

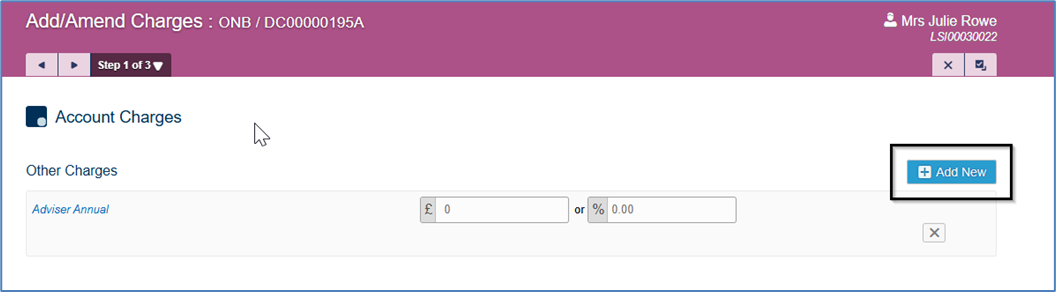

- Add New

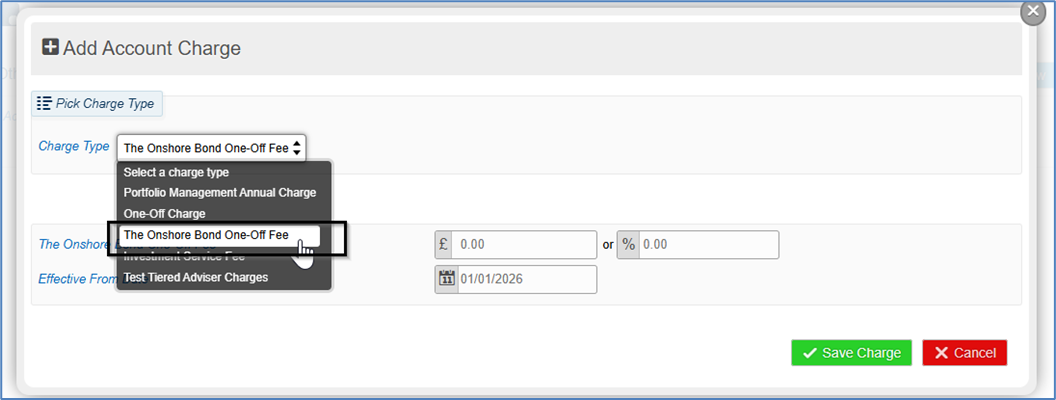

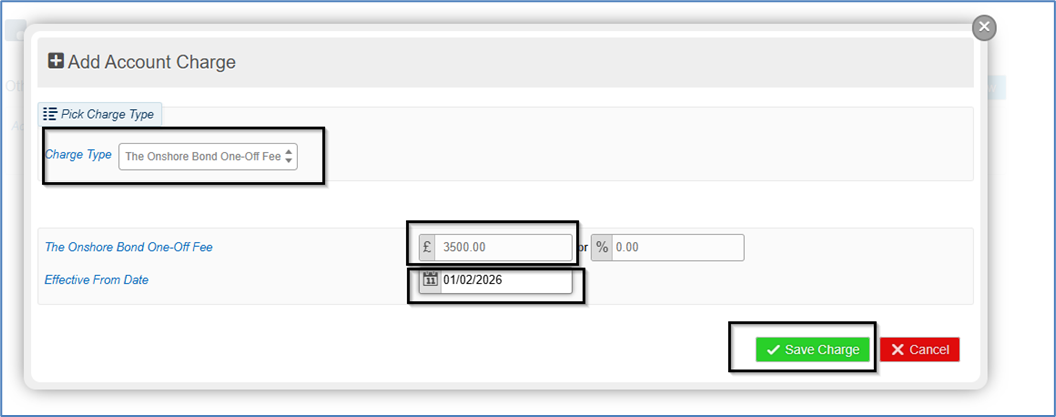

- Select “The Onshore Bond One-off Fee” from the dropdown

- Enter the required amount

- Type In the “Effective from date” which will be the next 1st of the month

- click “Save Charge”

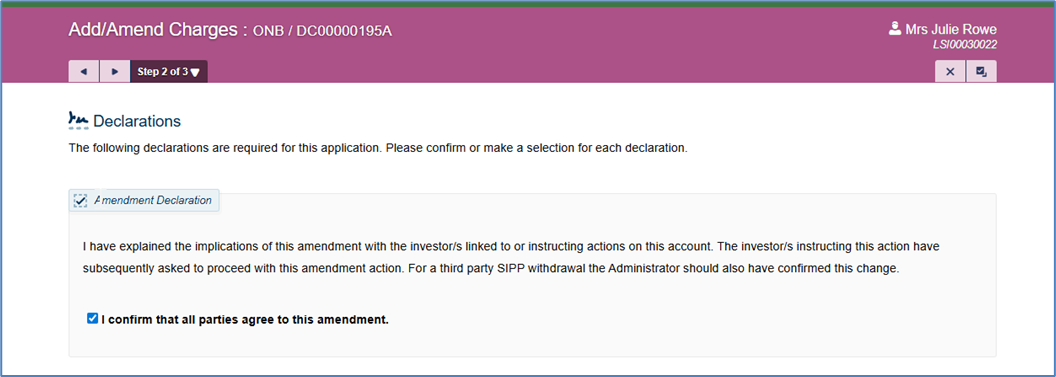

- Complete the three-stage process as usual

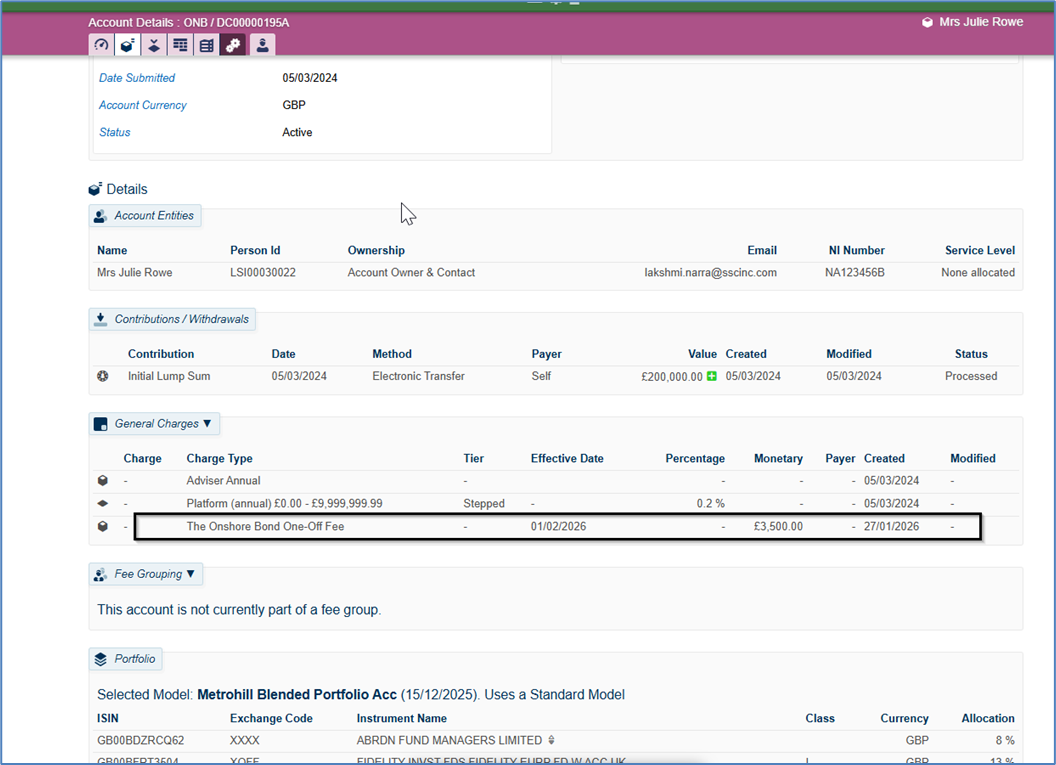

- The payment detail will show in the Account Details screen:

- Go to your investor’s Onshore Bond Wrapper, and in the All-Account Actions cog, select “Add/Amend Charges”

One-off and/or regular withdrawal/income requests are instructed via the Portal:

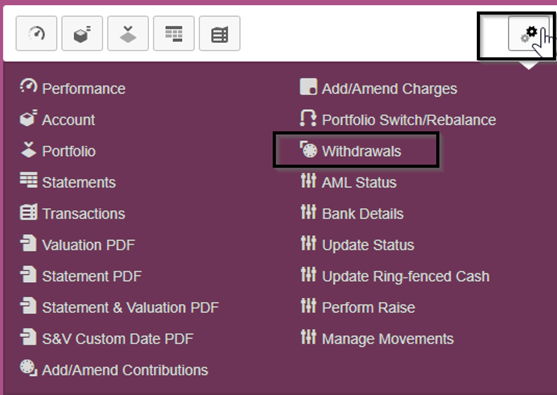

- Go to the All-Account Actions (double cog icon) dropdown and select Withdrawals:

- Follow the standard three stepped user journey

- The money will be sent to the Countrywide Assured bank account, to be forwarded onwards to the investor by them.

- Countrywide Assured will require confirmation from you that funds are being raised as necessary and the request for payment is in hand.

Your Relationship Manager at Countrywide Assured Limited will be able to assist with queries relating to this product, including Trust related matters.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article