Update Status provides IFA firms with self-serve functionality to change the Status of an Investor’s Account – the options are: Active, Deceased, Trading Suspended, Intention to Close and Non-UK Resident.

This article describes each Status, includes examples of where to use the Status, and general tips and FAQs around this Function as a whole.

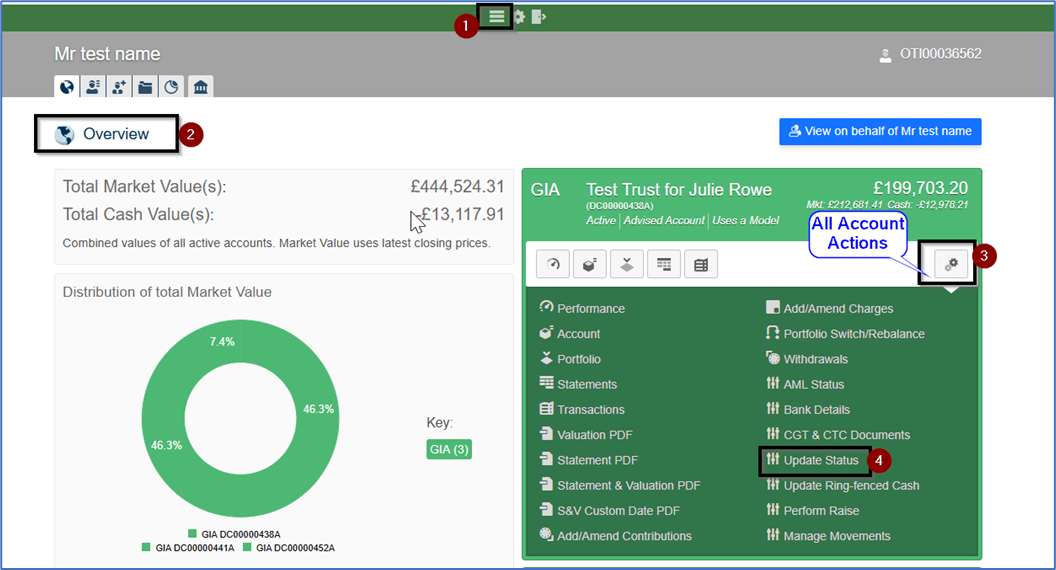

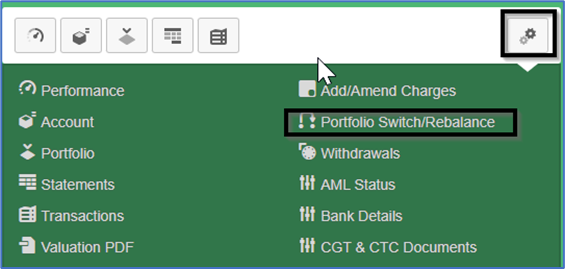

Update Status can be found in the All-Account Actions (double cog icon) Dropdown Menu in every open Account/Wrapper in your Investor’s Overview screen:

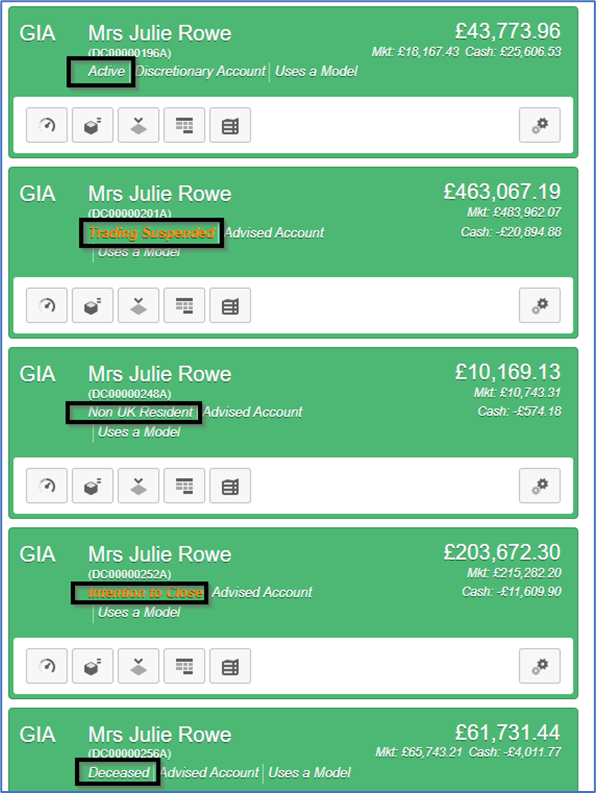

When you have changed the Status of an Account this displays in the Global Overview Screen:

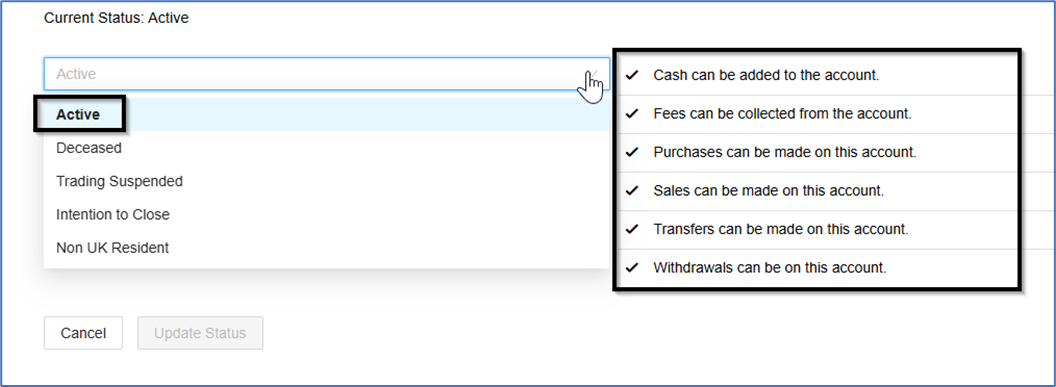

Active

This is the Default Status. Cash and Transfers can be added, Fees can be taken, buys and sells can take place and withdrawals can be instructed:

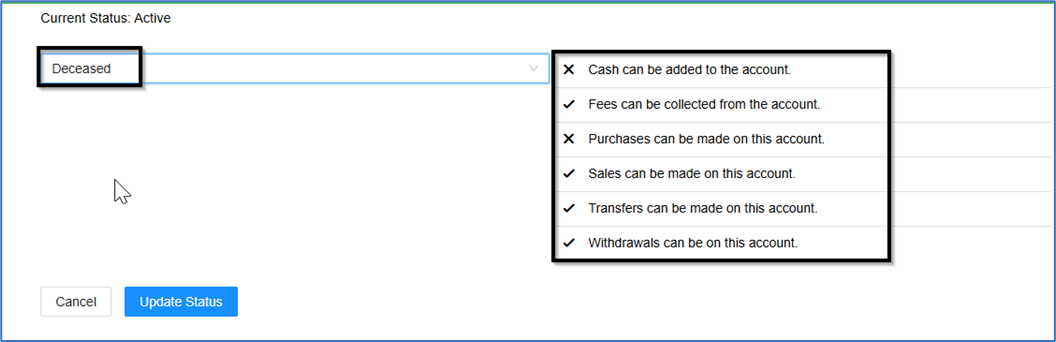

Deceased

One of the several actions you need to take when an investor has died is to set their Status in the Portal to Deceased. No more cash can be added to the Account and Purchases cannot be made:

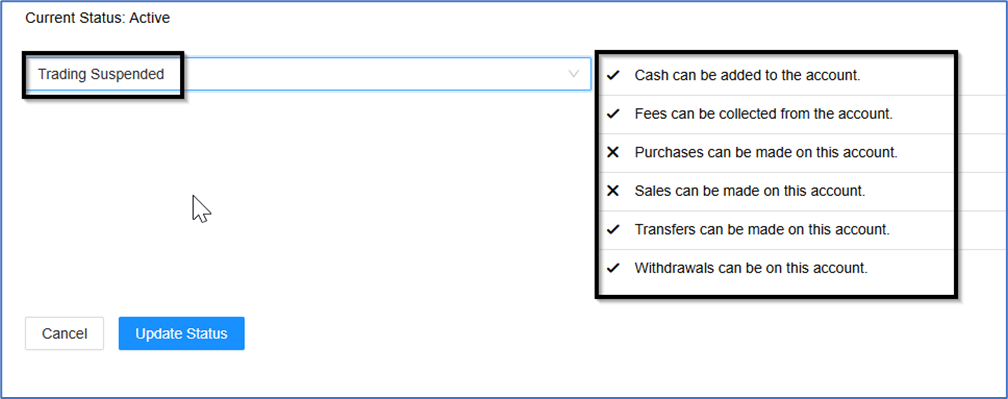

Trading Suspended

Care must be taken with this Status as it stops trading- apart from raising cash for fees to be paid.

Care must also be taken if this Account is being managed by a DFM- as Trading Suspended will stop the Account being included in their Rebalancing activities.

Use cases of why you may wish to change the Status of an Account from Active to Trading Suspended are:

- An in-specie transfer is in progress, and you do not want the Account to Rebalance yet

- CGT issues

- You wish to stop the Account from Trading for other reasons

- You wish incoming money to remain in cash. NOTE you can also instruct a Ring-Fenced to achieve this outcome.

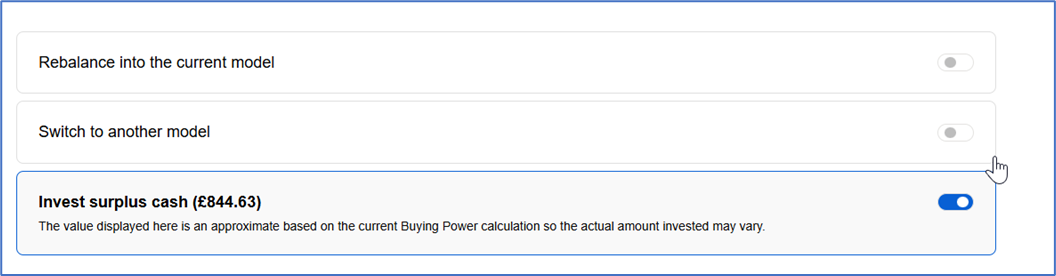

When you return the Status of the Account to Active you may also wish to instruct ‘Invest Surplus Cash’ to ensure that the Account is as fully invested as possible. This is an option in Portfolio Switch/Rebalance in the All-Account Actions drop down:

Close monitoring of your Investor’s Status is vital and you should diarise to review/remove Trading Suspended as soon as is applicable. See note at the end of this Guide on how the General MI Report can assist with this monitoring.

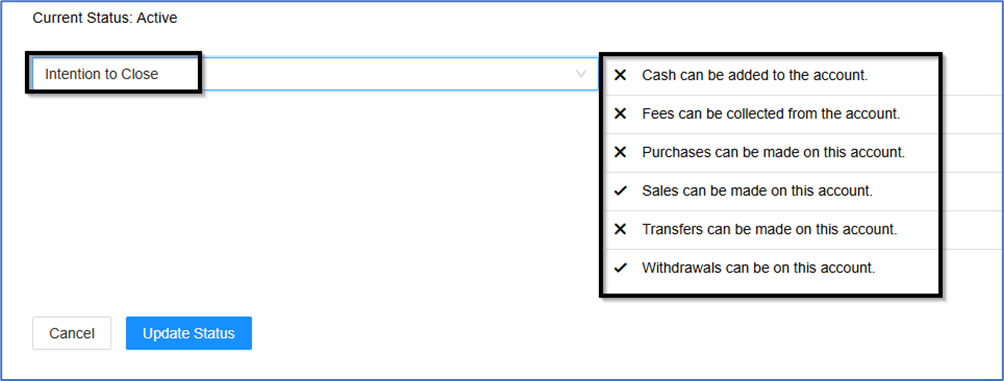

Intention to Close:

One of the several actions you need to take when an investor has decided to leave the Platform is to set their Status in the Portal to Intention to Close. No more cash can be added to the Account, Advice fees cannot be taken, and Purchases cannot be made. Sales and withdrawals can still take place:

NOTE: Intention to Close Status will be automatically set by the System if a full Withdrawal of funds is instructed.

Please take care with this – especially in the example of a Flexible ISA where a full Withdrawal could be instructed, and then later in the year a top-up is subsequently submitted.

In this scenario, please ensure that you have first reverted the Account Status to Active. (If the Status remains at Intention to Close, the expectation will be archived, and the action will fail.)

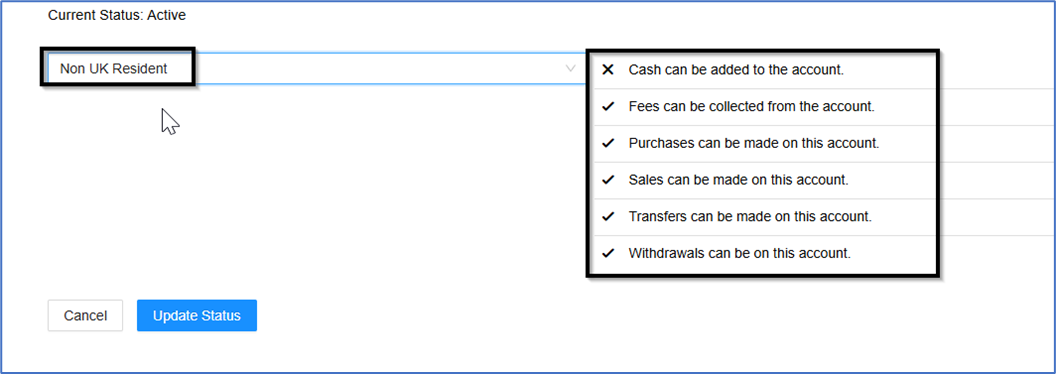

Non UK Resident:

If your investor moves abroad, you must change their Status in the Portal from Active to Non UK Resident. No more cash can be added to the Account, but all other activity can still be supported.

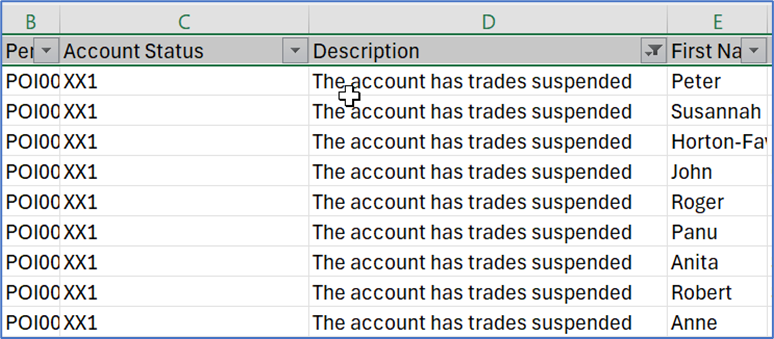

Your Daily General MI Report provides information on the Status of all Accounts in Columns C and D. For example, Account Status XX1 is our back-office code which is described in English in column D: “The account has trades suspended”.

This should be used to monitor and ensure that no Accounts have the incorrect Status:

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article