When you are notified of a client’s death, please follow the steps below to ensure the SIPP is administered in line with HMRC regulations and within the required timeframes.

Initial Actions

Update the SIPP Account:

- Change the account status to Deceased via the portal

- Cease any ongoing adviser fees immediately.

Notify Us:

- Raise a ticket via Freshdesk specifically for the SIPP to inform us of the death.

Required Documentation

To ensure that benefits payable under the SIPP are paid in accordance with HM Revenue & Customs guidelines and that any benefits have been dealt with within 2 years of the notification of death. Please provide us with the following documents once available:

- Certified Copy of the Death Certificate

- Certified Copy of the Last Will and Testament

- Confirmation of any financial dependants

- Details of all benefit crystallisation events (BCEs) prior to 6 April 2024

- Details of any relevant benefit crystallisation events (RBCEs) after 6 April 2024

- A copy of any Transitional Tax-Free Cash Certificate

- Additional documentation depending on the intended method of benefit distribution (see below)

As scheme administrator, we are required to demonstrate that we have considered how and to whom benefits should be paid. We may request further information or documentation from you or the executors based on our review.

Benefit Distribution Options

Transfer to a New Dependant’s SS&C SIPP

If the beneficiary wishes to receive benefits via a new SS&C SIPP:

- Set up the new SIPP via the Portal using the standard onboarding process.

- Select Internal Transfer.

- Provide the new account number.

Lump Sum Payment to Individual(s)

If the benefits are to be paid directly to one or more individuals:

Please provide the following for each recipient:

- Copy of their passport

- Recent bank statement in their name

- Confirmation of their National Insurance number

- Written confirmation of how they wish to receive the benefits

- A signed instruction from all recipients confirming, all assets are to be sold and the trading account is to be closed

Transfer to Another Provider

If the beneficiary wishes to transfer the benefits to another pension provider:

- Select the receiving pension scheme and ask them to contact us to initiate the transfer.

- Notify us of your decision.

- Provide a copy of the recipient’s passport and/or driver’s license.

Additionally, the following declaration must be completed, signed, and dated:

I confirm that I designate my share of the last <insert policyholder’s name>’s pension fund to being available for Beneficiary Flexi-access Drawdown and do so on the understanding that I am required to give instruction to transfer the designated amount to a separate pension arrangement in my own name.

I understand that my Beneficiary Flexi-access drawdown designation request will not be accepted until such time as you have received a valid transfer application and that you reserve the right, at your discretion, to withdraw the option of Beneficiary Flexi-access drawdown and pay the death benefit due to me as a lump sum death benefit payment, if a valid transfer application is not forthcoming within 30 days of this declaration.

Full Name:

Date:

Beneficiary Signature:

Important Timeframes and Tax Implications

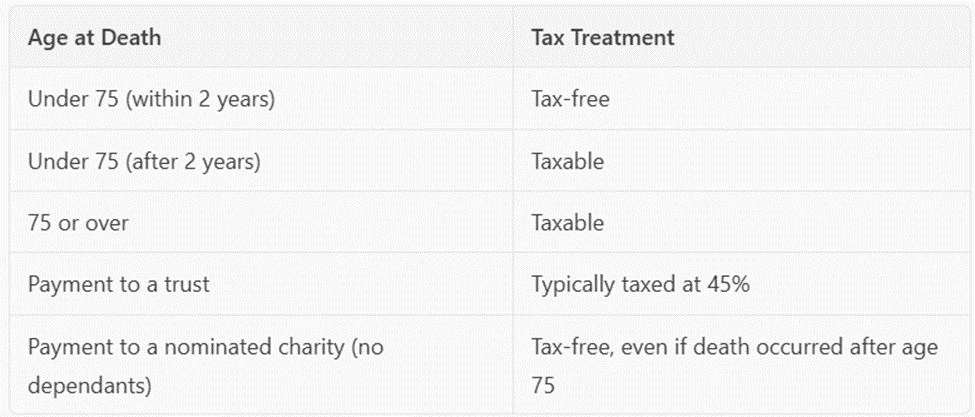

- If benefits are not paid within 2 years of the date of death notification, or if the member was aged 75 or over at death, the benefits may be subject to tax.

- If a claim is not completed within 6 years of the member’s death, the right to claim may be lost. However, please still contact us so we can review the case.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article